Like so many other sectors, the retail industry is currently undergoing enormous changes. Many factors play a role, the biggest one being the steady implementation of new technology. There is no reason to believe that these changes will stop any time soon, quite the contrary.

by Guillaume Arnal

This article will review some changes in customer behaviours which accompany technological innovation and have a significant impact on the industry – mainly the shift to smaller, more specialised shops. The article will also highlight some technological developments currently in their early stages, and which are likely to be more prominent in the coming years.

Customer behaviours change

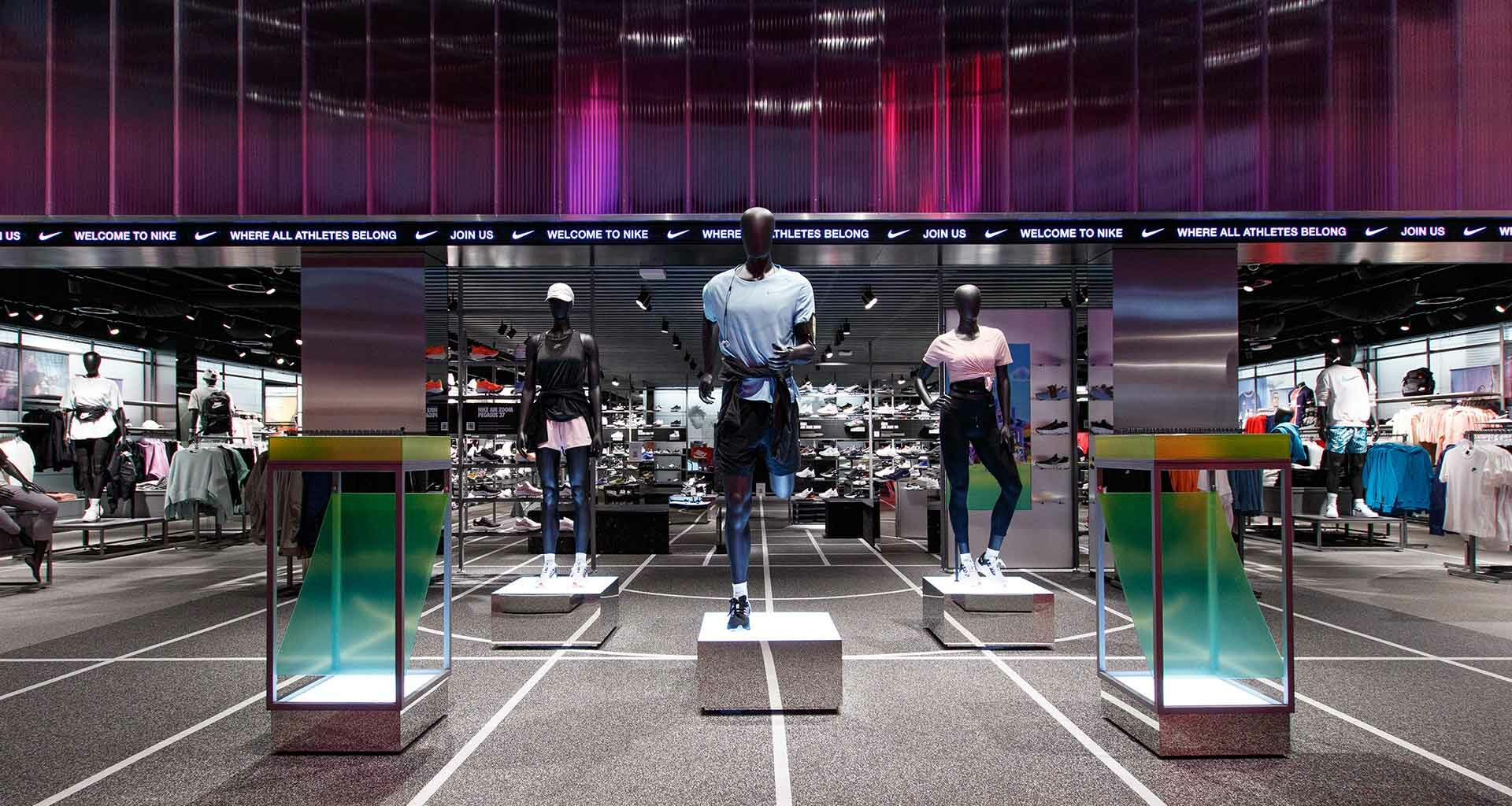

Now more than ever, what consumers want and expect is an improved customer journey experience, and it should be simpler and seamless. This change in the purchase journey is particularly impactful and challenging to high street retailers. One consequence is the growing success of autonomous stores, equipped with walkout technology. The idea being to shift control over the interaction of the purchase journey back to customers. This is increasingly important for merchants. In contrast, there is a noticeable decline in the traditional check out.

Another aspect is the decline of hypermarkets, as consumers want smaller shops with dedicated products instead. As a result, we are seeing a trend where bricks and mortar retail businesses are becoming smaller, more specialised, with additional in-store marketplace and strong online presence. This in turn further enables omnichannel use cases such as click and collect. This trend is something that is becoming increasingly widespread across the whole retail industry. Large merchants in particular want to reduce the size of their shops. Retailers can adapt their offering to propose more specific products for higher rates of conversion.

Reducing shop sizes is just one part of the equation. Client retention is key – merchants must improve knowledge of their customers via the collection of data – in accordance with regulatory compliance, assisted sales, personalisation, and strong loyalty programmes. These programmes, which are now standard across the retail industry, entail a very accurate knowledge of their own customers. Because when you offer better quality products to consumers, you want to make sure said products are sold. To do so, retailers are offering a more personalised communication to their customer – i.e. retailers are establishing a direct link, a one on one relationship with them. Similarly, retailers use big data daily to learn more about their customers and to better adapt their offering to align with their customers’ desires, which may change very fast.

Self-checkout is another example of how technology impacts customer experience, making it more autonomous and seamless. Retailers however would like to maintain assisted sales and moreover the ability to give advice to customers in a more convenient approach. To achieve that, I think these smaller, specialised stores need to invest in add-value services. And one way is the training of staff, so that employees are more familiar with the offering and are able to give advice and personalised information to customers.

Upcoming trends

Innovation is booming in the retail sector and there are some technologies still in the early stages of development, which are predicted to become massive features in the coming years.

Live Shopping is one such innovation, and one we at Worldline are particularly excited about. This ecommerce trend enables retailers, influencers, or celebrities to promote and discuss products and services with shoppers via livestreaming video on their smart phones, laptops, or any other smart devices. Consumers in turn can purchase these products in ‘real time’. Live Shopping first started in China – where it is proving increasingly successful with online shoppers, especially regarding fashion and cosmetics products. The technology is now spreading across the globe.

Our partners’ statistics reveal that online consumers using Live Shopping have an average conversion rate of 17%, in comparison to the average e-Commerce transaction conversion rate of between just 1-2%. During Live Shopping events this can be as high as 30%. Retailers can set up a live stream on social media platforms such as Instagram and TikTok, which are overwhelmingly popular among the younger generations – the mainstream users of Live Shopping.

Engaging livestream videos and real-time feedback can help shorten the shoppers’ decisioning process, turning every purchase intent of consumers into real sales, which also boosts conversion rates. Also, by having a greater data-set available to them through online retail platforms, merchants can judge the popularity of their offering and assess their consumers’ wishes and expectations.

Similarly, the Metaverse is another technology that looks set to play a significant role in the retail ecosystem in the coming years. This technology is often associated with the development of “web 3.0” and both are expected to be critical to the future of eCommerce. In short, the Metaverse is a sophisticated network of 3D virtual worlds, tailored towards social and commercial interaction, and can be accessed via a mobile browser, web browser or augmented reality headsets. As such, this technology will provide a platform for retailers to offer their products to consumers online. Therefore, developing a presence in the Metaverse as early as possible is considered a strategic investment.

Just as in the physical world, payments in the Metaverse can be made in various ways, but the most common is through blockchain or digital currencies which can be used to purchase retail products. With that in mind, payment providers must look to proactively explore how to build in Metaverse payment products and services, to create the ultimate virtual payments experience complete with new merchant sales channels and virtual showrooms.

There are other technological innovations currently under development, the future impact of which is slightly more prospective, if not debatable. Biometrics adapted to payment is one of them – the technology that uses biometric authentication based on physical characteristics to identify the user.

To clarify, biometric payment exists on our mobile – via digital wallets for instance. The question now is, can the technology be adapted to payment terminals? In other words, can payment terminals be used to authenticate payments using biometrics? That is not something that is likely to be deployed in the coming years – at least in the USA or Europe, due to the many regulations in place.

For more information please visit: WL Retail Suite (worldline.com)

After 22 years of launching complex projects with different large groups in the technology sector, Guillaume Arnal is now Offer Manager for the Retail Segment at Worldline. With an engineering background and an MBA from Sorbonne University, Guillaume is passionate about product innovation, digitalisation, and payment services. He understands the new use cases and tries to adapt them into marketing offers, to help merchants with their new challenges.

After 22 years of launching complex projects with different large groups in the technology sector, Guillaume Arnal is now Offer Manager for the Retail Segment at Worldline. With an engineering background and an MBA from Sorbonne University, Guillaume is passionate about product innovation, digitalisation, and payment services. He understands the new use cases and tries to adapt them into marketing offers, to help merchants with their new challenges.

Photo by Craig Lovelidge on Unsplash