Introducing the Snack 50 Psych-Pulse

The neuroscience-driven team at Alpha-Diver recently released the “Snack 50 Psych-Pulse” – the first comprehensive measure of the psychological drivers of snack brand performance. Topping the list are Reese’s, Lay’s, Walmart’s Great Value, Hershey’s, and M&Ms.

What makes this ranking unique is WHY these brands come out ahead. While typical brand ranking lists are based on popularity polls, sales volume, or reviewer critiques, we derived the Snack 50 Psych-Pulse rankings from three key aspects of consumer psychology as it relates to brand consumption.

The real WHYs behind brand performance

We rank each brand via our unique Psych-Pulse composite score, combining these three key metrics:

- Routinization: how ingrained is the brand into consumers’ lifestyles? In other words, how frequently do they perceive they use it? Is it an occasional indulgence, or a daily habit?

- Emotion: how attached are consumers to the brand? Would it be relatively easy or rather difficult for them to stop using it?

- Trajectory: what’s the brand’s usage momentum? Do consumers perceive their usage to be increasing, staying stable, or decreasing?

Considering these three components together not only produces our ranking but explains WHY these brands rate where they do. It also reveals the challenges or opportunities facing them in-market. The Snack 50 Psych-Pulse includes brands spanning 12 categories that drive $50 billion in annual sales.

At the category level, chocolate candy, potato chips, and cookies are top snacking options in consumers’ minds. (As noted above, Reese’s, Hershey’s, M&Ms, and Lay’s are four of the top five rated brands). Jerky / meat snacks, snack / trail mixes, and pretzels are less psychologically popular.

Unpacking some top scores: what Reese’s and Great Value are doing right

Reese’s component scores reveal WHY it ranks #1. Reese’s rates in the 98th percentile on routinization and tops the list for emotional attachment. In other words, consumers eat Reese’s products regularly, and out of all 50 brands profiled, Reese’s is the one consumers would find the hardest to have to give up. Further, despite already being a frequent part of consumers’ lifestyles, Reese’s usage trajectory is stable. While consumers don’t claim they’ll be eating even more Reese’s in the future, they aren’t looking to lower their intake either.

Of the top five brands, only Walmart’s Great Value has positive momentum: consumers expect to buy Great Value snack items even more in the months ahead than they do now. While Great Value isn’t as routinized as Reese’s, it still rates highly on this measure, and the positive momentum indicates consumers do not see their current usage of Great Value snacks as saturated. They have room (and desire) to keep growing the brand’s role in their lives.

Private label momentum is strong, for a surprising reason

What’s perhaps most noteworthy about the trajectory measure are the brands joining Great Value on its upward path. Most brands registering upward momentum are “store brands” or private labels: Great Value, Amazon’s Aplenty and Happy Belly, Target’s Favorite Day and Good & Gather, Aldi’s snack brands, and Costco’s Kirkland Signature all rate in the top quintile on trajectory. While routinization may be lower for most of these brands (several of which are newer to market), consumers’ emotional attachment to them is also solid.

Many companies assume private label brands are growing due to practical price trade-downs, but our analysis reveals that consumers have much more emotional affinity for these brands: they serve a key psychological need for consumers that goes beyond just price. We see that consumers also see many of these brands as socially agreed upon options that serve a sense of connection and belonging.

Gen Z bucks the gen pop trend on many brands

While Reese’s is solidly #1 with both genders, Millennials, and Gen X, and #2 with Baby Boomers, it doesn’t make the top 5 among Gen Z, dropping down to #7. Oreo takes the top spot with 18–25-year-olds, followed by Doritos. Twix is another brand whose rating increases among Gen Z.

We’ll be releasing a Gen Z version of the Snack 50 Psych-Pulse soon that digs deeper into how this young and important buyer group feels about top brands, and which categories are poised to grow or decline with this audience.

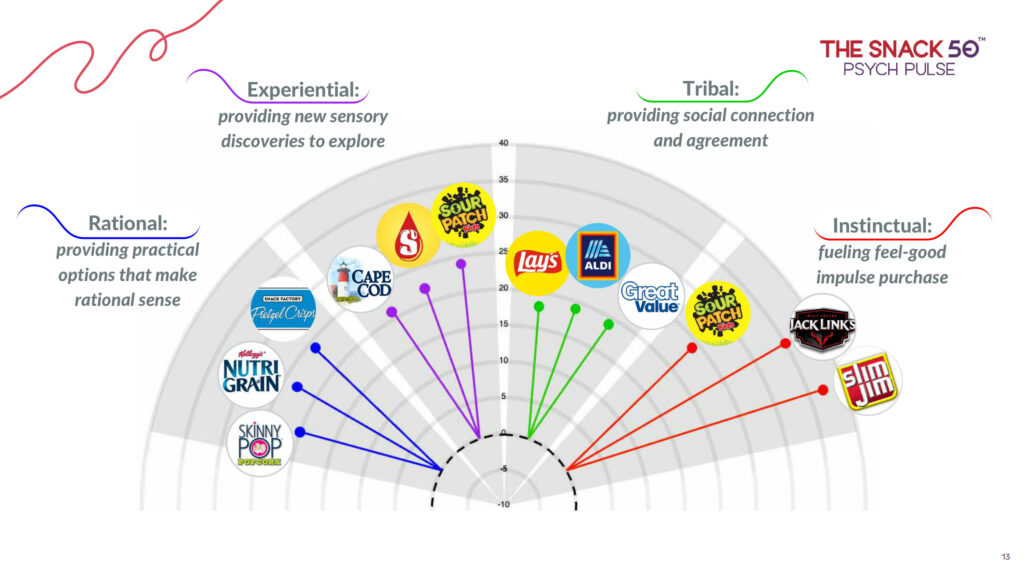

Drivers of brand choice: four “jobs” brands do for consumers

Another key component of our brand assessment measures how consumers associate brands with the four core psychological drivers of behavior. Think of this as our gauge of what “psychological job” these brands do for consumers.

- Rational: snack brands that provide practical / sensible options. Top brands doing this job are Snack Factory Pretzel Crisps, Kellogg’s Nutri-Grain, and Skinny Pop.

- Experiential: brands that provide new sensory discoveries to explore. Top brands serving this role are Sour Patch Kids, Starburst, and Cape Cod.

- Tribal: brands that provide social connection and are culturally agreed upon. Key brands in this space are Great Value, Aldi, and Lay’s.

- Instinctual: these snack brands fuel feel-good impulse; they let us blow off some steam. Top brands in this space are Slim Jim, Jack Links, and Sour Patch Kids.

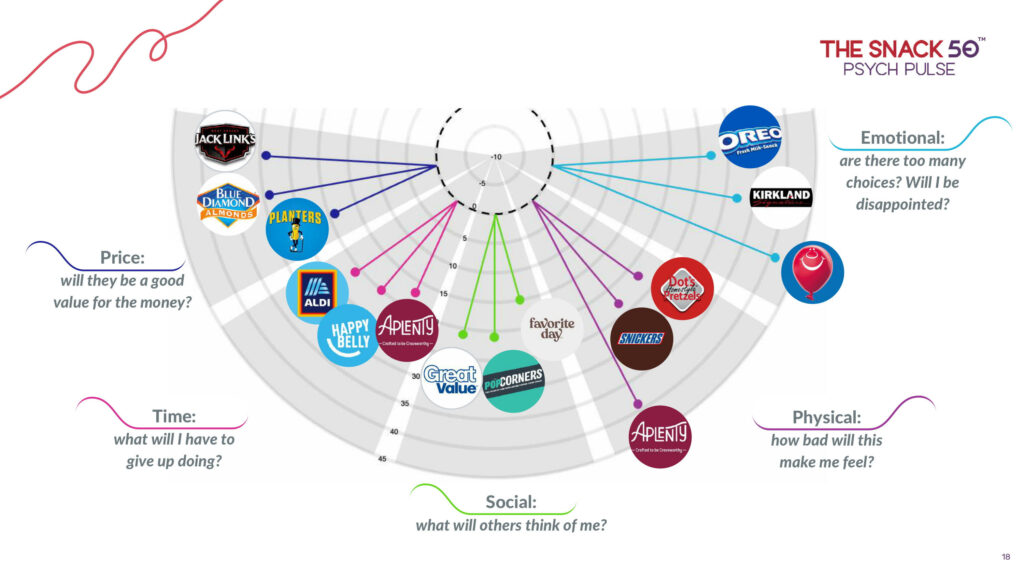

Barriers to brand choice: it’s not all about price

Lastly, we assess which brands consumers associate with each of the five psychological barriers to behavior. Think of these as limitations a brand needs to mitigate: if the drivers / psychological jobs are the “carrot” brands should sweeten, these are the “sticks” brands must shorten.

- Price: will the brand be a good value for the money? This is a key barrier facing Jack Links, Blue Diamond Almonds, and Planters.

- Time: what will I have to give up doing (if I spend time on this brand?) Key barrier for Aldi, Happy Belly, and Aplenty.

- Social: what will others think of me for using this brand? Key barrier for Great Value, Popcorners, and Favorite Day.

- Physical: how bad / unwell will this brand make me feel? Key barrier for Great Value, Snickers, and Dot’s Pretzels.

- Emotional: why does this brand have so many choices? Will I be disappointed? Key barrier for Airheads, Kirkland Signature, and Oreo.

Research Methodology

The Snack 50 Psych-Pulse rankings are based on the psychology of a U.S. representative sample of 1,482 adults ages 18-75, conducted online in March 2023. The sample is matched to US census data on gender, age / generation, and ethnicity. Respondents were 51% female, 49% male, with an average age of 45, and a median household income of $50,000.

Alpha-Diver conducted the study in partnership with The Food Institute, a leading food industry media company. The complete list and report is available at:https://alpha-diver.com/snack_50/

Photo by Ryan Quintal on Unsplash