How Profitable is Your Loyalty Marketing?

Let’s look at common spots where loyalty investments are most vulnerable to loss, the benefits of collaboration models and the three best opportunities for loyalty spending.

Most marketing efforts produce conversion rates of less than 5%, signaling a crisis of communication with a make-or-break number of potential loyal customers. This article explains how loyalty partnerships among complementary brands can produce more comprehensive customer understanding that drives down cost while strengthening engagement – and how to apportion loyalty investments.

In many cases, less profitable than the sales or value-added tax on a grocery bill.

The conversion rate of most marketing efforts is just 1% to 4%, meaning for each dollar invested, nearly 95 cents misses its mark. I propose there is a direct correlation between this miss and customer understanding.

By Chuck Ehredt

If some of that 95 cents were better invested in data insights that reveal shopper behaviors both within and outside a particular brand, the balance of the spending could produce more effective engagement strategies.

Achieving this is not a mystery – the key is understanding customers’ propensity to respond to various offers based on lifestyle preferences and segmentation.

A common method to enhance customer understanding is partnering with other companies through loyalty programs. These collaborations allow members to earn and redeem reward currencies across a spectrum of brands. The participating brands, in turn, can share the shopper insights so they may better engage high-potential prospects.

For example, a customer who chooses premium gas at the fuel pump, or buys pricier brands at the supermarket, is more likely to respond to an upgrade offer. Alternatively, a customer who buys dress shirts at Walmart will be more responsive to discount offers.

Yet in many parts of the world, and notably the United States, these collaborations are dramatically limited in their capabilities. In many cases, organizations haven’t had the infrastructure or capital to invest in multi-partner coalitions. Some companies simply don’t want to share their customer data.

But this reasoning is outdated. Technology has advanced so strategically in recent years, particularly in terms of microservices and SaaS platforms where brands share technology costs, that any program operator should benefit from collaborative loyalty with little investment.

Let’s look at common spots where loyalty investments are most vulnerable to loss, the benefits of collaboration models and the three best opportunities for loyalty spending.

Long-Term Rewards Are Losing to Short-Term Thinking

The problem for many loyalty programs isn’t lack of profit; its wasted potential.

At the root of this lost potential is the tendency to focus on investors’ demand for short-term profits. In the realm of loyalty programs, short-term profits derive from:

- members redeeming points for excess inventory the brand would mark down anyway;

- selling points to partners, which in turn issue that currency;

- paying exchange partners to take on points liability, but paying them less than value of that liability; and

- breakage – when the customer’s points expire, eliminating liability.

These are fine in moderation, but it’s more important that customers perceive value in the currency(ies) offered, so they want to collect them in the first place. Each customer may prefer one loyalty currency over others. It may (or may not) be yours.

The byproduct of such activity is better data insight.

The best way to wriggle out of the short-term grip is to reposition the loyalty program from a standalone initiative to a multi-partner strategy, which leverages the shared investments. The more members interact with the program, the more comprehensive their behavioral insights and, ultimately, the more effective the marketing.

When customers earn and burn with frequency , it demonstrates they are obtaining value.

It’s a Virtuous Cycle

Yet this virtuous cycle remains relatively unrealized in many markets, due to legacy infrastructure costs and data-sharing concerns. Insight sharing via loyalty programs is the best option, because customers have opted-in to share their data in exchange for points.

It is a rational and legitimate value exchange.

With an affordable system such as this in place, organizations can measure ROI and issue the kinds of personalized messaging that motivates customers to engage and propel that virtuous cycle.

Where Should Loyalty Investments Go? 3 Opportunities

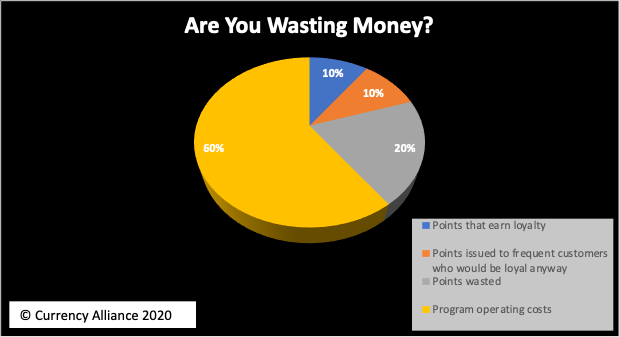

Based on our estimates, only 10% of reward points issued generate actual “loyalty” among members – meaning they return to the brand regularly due to the overall customer experience (not just price and convenience).

Another 10% of reward currencies are issued to members who would shop the brand without the points, typically due to habit or convenience. And 20% of points are unredeemed, or wasted.

The balance (60%) of the loyalty budget is earmarked for running costs. (See chart below.)

Based on this model, there are three key opportunities for a better loyalty ROI:

1: Reduce running costs with microservices: The running costs of a reward program can be cut to as little as 25% with more affordable microservices – suites of modular applications that can nimbly manage otherwise cumbersome applications. A dedicated points bank provided as a microservice, for example, could plug into existing enterprise customer relationship marketing and campaign management platforms, eliminating the need for a dedicated loyalty program management system, with the secondary benefit of collating all customer data in one place.

2: The redemption experience. Too many reward programs focus on short-term profits, such as breakage. Long-term, this can be counterproductive. Instead, operators could profit from redemption options that have high perceived value at a reduced cost. These rewards can be provided by the loyalty operator and/or its partner brands and are much easier to source today.

3: Collaborative currencies. The benefits of the first two investments amplify when the infrastructure and reward currencies are shared among a group of partner brands. This enables members to earn and redeem rewards from the brands that make sense to them through just one collaborative program. Plus the model is less complicated for members as well as the partner brands because it operates under one lower-cost infrastructure. Our service, for example, charges clients a flat rate of 2% on the loyalty currencies issued or exchanged – which is typically a tiny percentage of incremental sales.

The Most Important Point in Loyalty is Where Brand Meets Customer

The value in loyalty marketing comes from the data. Brands that want to win long term must determine what customer insights are needed to improve conversion and then assemble the mix of complementary partners in order to obtain that data.

Reward program profitability is ultimately realized in the form of genuine loyalty, in which customers return to the brand because they feel meaningful value in experience, price and product – not simply because it enticed them with points or miles.

And that is long-term profitability, because the return on those more valuable customer experiences will pay back in the form of more frequent visits, bigger baskets, and from positive word-of-mouth.

Charles (Chuck) Ehredt is CEO of Currency Alliance, the global loyalty currency management platform.

Charles (Chuck) Ehredt is CEO of Currency Alliance, the global loyalty currency management platform.

Photo by Aaron Burden on Unsplash.