Worldline is a global leader in secure payments and trusted transactions. We sat down with Simone Lavicka, Worldline’s Head of Strategy, Marketing & Sales Enablement at Digital Commerce to get perspective on the trends and hurdles merchants are facing around the world.

is a global leader in secure payments and trusted transactions. We sat down with Simone Lavicka, Worldline’s Head of Strategy, Marketing & Sales Enablement at Digital Commerce to get perspective on the trends and hurdles merchants are facing around the world.

TheCustomer

With a global presence such as Worldline’s, you’re in a unique position to see the world’s payment activity through a variety of lenses – particularly as it relates to trends. Talk to us about some of the broader themes that Worldline is aware of – and leveraging in today’s marketplace.

Simone Lavicka

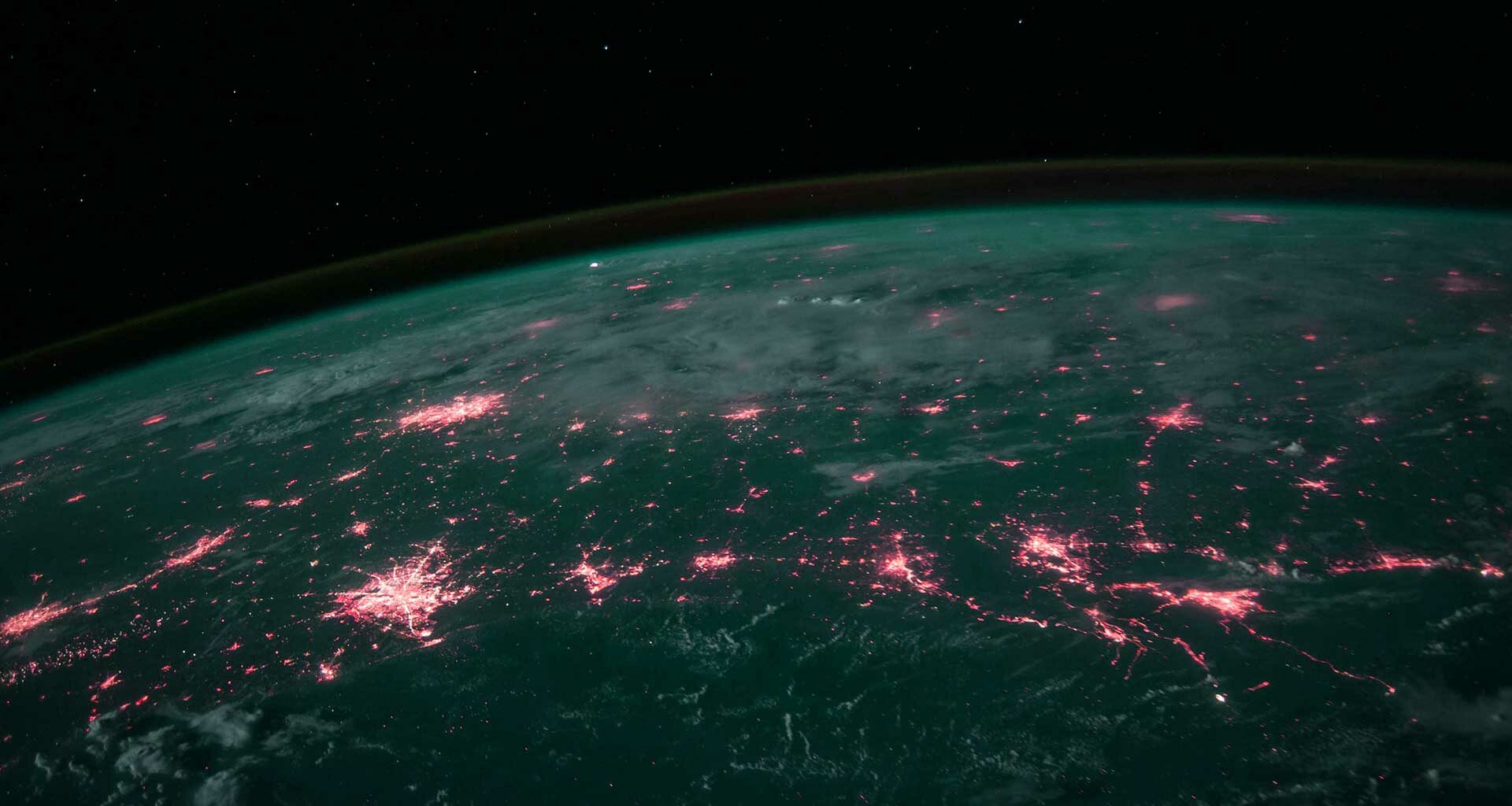

Today’s consumers prefer endless aisles, which by definition means greater choice and availability, multiple payment options and fast delivery of goods. Rapid development of internet capabilities, increasing mobile connectivity, cross border trade agreements and pro-business regulatory policies have already accelerated e-commerce. Robust supply chains with efficient distribution, improved warehousing and quick delivery systems further act as catalysts.

In today’s world, merchants, brands & consumers are inextricably linked leading to a growth in demand and confidence in ecommerce. Last year, the pandemic induced a slowdown and consumers shifted their shopping pattern to purchasing only essential items from local merchants. Whilst the pandemic & subsequent national lockdowns significantly affected supply chains, most merchants shifted to digital sales channels and leveraged ecommerce technologies to stay relevant and meet expectations. In 2020, over 2 billion people purchased goods or services online, with e-retail sales in excess of 4.2 trillion USD worldwide1.

We also see consumer payment preferences shifting from traditional card payments towards alternatives. Payments have also evolved to enhance convenience and offer seamless checkout experiences while ensuring strong security (fraud prevention). Recently we saw a surge in the use of digital wallets and Buy Now Pay Later (BNPL). Real-time payments are playing an increasingly important role in the global payments’ ecosystem (number of transactions grew by +41% in 2020 often in support of contactless/wallets and e-commerce). For merchants, high conversion rates while maintaining seamless, pleasant, and increasingly contactless payments along with simplification in merchant onboarding process becomes an important factor. Established businesses must decide whether to go deeper into their core business or expand into new segments/ markets.

TheCustomer

What do you see as the major shifts in say, 5 years from now? Are there regional shifts that brands and merchants should be preparing for now?

Simone Lavicka

At Worldline we’ve identified the five key areas of interest that we are monitoring closely, namely: innovation, consumer behavior, cross border payments, competition and regulations. When it comes to innovation, we expect to see more technological advancement in the fintech space with the rise of technologies such as Artificial Intelligence (AI) & Machines Learning (ML) driven data analytics, block chain based digital currencies (e.g., CBDC), embedded payments (in-vehicle payments, home assistant payments) etc. Moreover, consumers today are increasingly connected on social media leading to the rise of social commerce (Facebook, Instagram etc.). Brands will increasingly be shifting to live streaming events and influencers for product promotion. The ongoing repercussions of the pandemic is also shifting the mindset of consumers towards ease & safety of purchase experience – such as, for instance, curbside pickups, home delivery. Sources of inspiration for online shoppers will be digital channels which will increase the need for merchants to have a strong digital footprint. Another important trend is the rise of cross border shopping. It has already begun, and we expect this to continue over the next five years. Some of the important cross border corridors are: Europe – US, Europe – China, Europe – Russia, China – Russia, US- LATAM, US-APAC & Europe – APAC.

International marketplace merchants are also exploring managed payments wherein they retain control over purchasing experience of buyers and sellers. The buyers will be able to pay on the platform without being directed to third party sites and sellers receive their payments directly from the platform. We can expect deeper payments integration (embedded payments in platforms e.g., marketplaces, Independent Software Vendors, etc.). Merchants will have to offer products with embedded payment features & Value-added services leading to “Industry vertical” specific offerings. Additionally, we see the democratization of platforms and technology has lowered the barriers to entry and created more competition than ever before. We expect new competitors and further consolidation moving forward.

Lastly, we expect regulatory emphasis on Open banking & payment infrastructure. Initiatives such as Open Banking and Strong Customer Authentication (SCA) are expected to remain top agenda items for regulators & FinTechs alike.

TheCustomer

Your recent announcement – your partnership with Livescale – got a lot of attention here in the U.S. Talk to us about the strategies behind the partnership and where you see that going over the short term. Do you see live shopping jumping borders and coming to the U.S. at any sort of scale?

Simone Lavicka

Originating in China, livestream shopping is no longer a new phenomenon, but the norm. We see it becoming increasingly popular in Europe and in the US. This is because the sales volumes and conversion rates are so high and brands are reaching new customers with who they can build relationships. This year we saw 1,000+ live shopping events in the U.S., a 100% increase on the year before. We also see the use cases for live shopping expanding, from fashion and beauty, to electronics, food and luxury, and we see potential for industries such as travel and entertainment. We are just scratching the surface and the possibilities in this area are enormous.

Together with Livescale we are currently onboarding large merchants from Europe and the U.S. Going live is not a complex process, and we are already seeing some strong results. Live Shopping has been one of our major product introductions in 2021 and we are expecting mass adoption of this technology. Needless to say, it is still early days, but it’s a very exciting concept that is only just beginning to take shape in the retail and brand space – and Livescale is incredibly well positioned. We are looking forward to seeing it develop on the coming years.

TheCustomer

What can you offer merchants who are overwhelmed by the choices but who nevertheless need to move fast?

Simone Lavicka

At Worldline we have set up a verticalized business model with domain specific payment experts across different functions such as analysts, product managers, developers, partner managers, relationship experts, etc. Our collaborative approach enables our experts to closely monitor the pulse of the digital payments ecosystem. We understand that the needs of each merchant are different. Our experts can guide merchants on a wide range of topics such as geographic expansion, payment conversion optimization, country specific payment preferences, legal and compliance topics (e.g., we successfully implemented PSD2 SCA), settlement, etc.

We also have a dedicated fraud management team which works closely with best-in-class industry partners to co-create extremely robust systems for our merchants. In addition, our experts offer advice on offering secure payments. Our product and customer servicing teams collaborate with our merchants to implement unique product features very quickly, which results in seamless onboarding and support experience for our merchants.

Finally, to stay in the front seat of innovation we work closely with research organizations, industry peers and technology entrepreneurs and continually engage with partners and industry experts to help shape our thinking and direction.