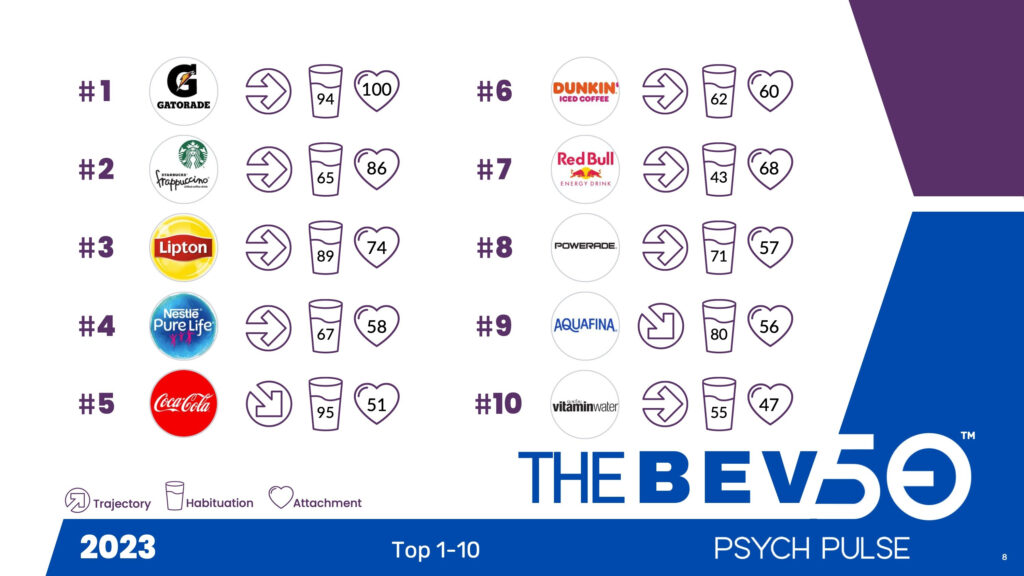

The most popular of 50 leading beverage brands in the U.S. are Gatorade, Starbucks Frappuccino and Lipton teas, while Rockstar energy drinks, Diet Pepsi and Diet Dr. Pepper diet rank 48th to 50th, according to The “Bev50” Psych-Pulse Brand Strength Index,” the first national measure of the psychological drivers of consumer brand behavior in the soft drink category.

Details of the top 50 CPG beverage brands, ranked according to a proprietary Alpha-Divermethodology will be revealed in a free webinar today, June 28.

Beverage Leaders and Laggards

Currently, at the category level, the top three performers are: still waters, soft drinks, and ready-to-drink coffee. Brands with the strongest momentum (brand trajectory) include: Chameleon Hand-Crafted Cold Brew, PRIME and Electrolit; the weakest in brand momentum include: 7-Up, Sprite and Canada Dry.

The bottom three category laggards include enhanced waters, ready-to-drink teas, and sparkling waters. Gen Z (15% of the US adult gen pop) prefers: Starbucks Frappuccino, Gatorade, Dunkin Iced Coffee, AriZona Iced Tea and Nestle PureLife. Baby Boomers (27% of US adults) go for: Gatorade, Lipton, Aquafina, Dasani and Coca-Cola.

The Method

The Bev50 survey, created by neuro-market research firm Alpha-Diver, in partnership with Beverage Digest, is based on 100+ psychological metrics across a representative US population sample.

The survey, fielded in April and June, 2023, among 2,970 respondents, was conducted across eight categories, from multi-billion dollar brands to challengers. Fifty-one percent of responders were female, with an average age of 45 and a media income of $59,000. Forty-two percent of responders live in suburban settings, 36% in urban areas and 22% in rural communities. The generational breakdown: 15% Gen Z, 32% millennials, 27% Gen Xers, and 27% Baby Boomers. Two-thirds (66%) of responders were White, 12% Hispanic, 14% Black, and 6% Asian / Pacific Islander.

“Our goal was to produce a survey inclusive of all ethnic groups drawn from the key demographic and geographic sectors that explains WHY consumers behave toward brands in the soft drink sector,” said Hunter Thurman, president of Alpha-Diver. “Data drawn from this large sample enabled us to rank the brands according to three dimensions: consumer purchase behavior, their emotional attachment to brands, and the trajectory of brand usage –increasing, stable or declining. Together this data set provides deeper insights into the beverage sector than previously available.”

What Drives Consumer Behavior

Alpha-Diver’s proprietary research methodology breaks down brands by the four leading drivers of consumer behavior, as well as mapping their sales trajectory, the strength of consumers’ attachment to a brand, and their habituation or routine consumption of beverage brands.

Experientially-driven brands – providing new sensory discoveries – standouts are: AHA sparkling water, Starry Lemon Lime, and LaCroix.

Rationally-driven brands – practical options – Dasani, Celsius, and Aquafina lead.

Tribally-driven brands –providing a social connection among users – Lipton, Pepsi, and Nestle Pure Life

Instinctual – feel good, impulse driven brands – Red Bull, Monster and Mtn Dew, are favorites.

The Bev50 PsychPulse also includes key data on the five potential barriers to consumer brand choice, including:

Price: does the brand offer a good value?

Time: what must I give up doing to obtain?

Social: what will others think of me?

Emotional: Will I be disappointed by the beverage?

Physical: How will dinking this beverage make me feel?

About

Hunter Thurman is president of Alpha-Diver, the market research firm that applies neuroscience to more deeply understand marketplace behavior. The firm’s neuroscientists and strategists work with leading brands, retailers and the Wall Street analyst community to explain, measure, and predict consumer behavior. Clients include: Coca-Cola, Nestle, McDonald’s, and Kellanova, among dozens more.

About Beverage Digest

Beverage Digest serves top executives who drive results across the global beverage industry. BD offers a carefully curated subscription newsletter, go-to reference books illuminating brand-level sales data and US soft drink franchise territories, and an annual Future Smarts conference. These resources are designed for executives who want to stay current on the most important developments and data-driven insights.