While the lines between sports and energy drinks might be blurring, decision science explains why, and what to do to stay competitive.

Earlier this summer, market research company Alpha-Diver and Beverage Digest released the Bev 50 Psych-Pulse report, the industry’s first measure of the psychological factors driving beverage consumption behavior. In this report, Alpha-Diver’s team of decision scientists ranked 50 beverage brands across 8 categories based on consumer perceptions as measured by three metrics:

— Routinization: how routine a brand’s consumption has become.

— Attachment: how difficult the brand would be to give up.

— Trajectory: whether a brand’s usage is increasing, stable, or decreasing.

“This not only rates and ranks these power brands but explains the ‘why’ behind their performance and reveals any challenges ahead,” said Alpha-Diver Director of Research and Principal Neuroscientist T. Sigi Hale, PhD.

Alpha-Diver has now dug deeper into those study results specific to two of the most profitable and competitive beverage categories—sports drinks and energy drinks. As these categories continue to evolve and the lines between them continue to blur, consumer insight not only explains the blurring, but also offers strategic guidance for brands on how to navigate this increasingly complex space.

Diagnosing these drinks’ “job to be done” for consumers:

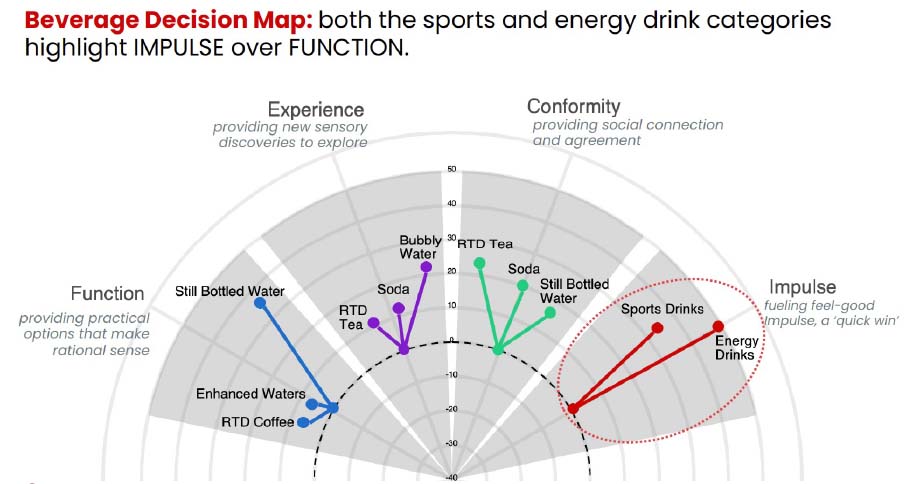

First, Alpha-Diver measured how respondents associate the sports and energy drink categories, and many popular or growing sports and energy drink brands, with the four subconscious drivers of decision making:

- Function: drinks that provide practical options that make rational sense.

- Experience: drinks that provide new sensory discoveries to explore.

- Conformity: drinks that provide social connection and agreement.

- Impulse: drinks that fuel feel-good impulse, and “quick wins.”

These drivers indicate how consumers think about the different categories and brands. In other words, they describe what “emotional job” these products do for them.

The data reveal that sports and energy drinks largely do the same emotional job for consumers, which is to serve the Impulse drive to “feel good right now”. This is despite the ostensibly functional benefits both categories provide.

Next, Alpha-Diver looked at specific brands within each category and what jobs consumers assign them.

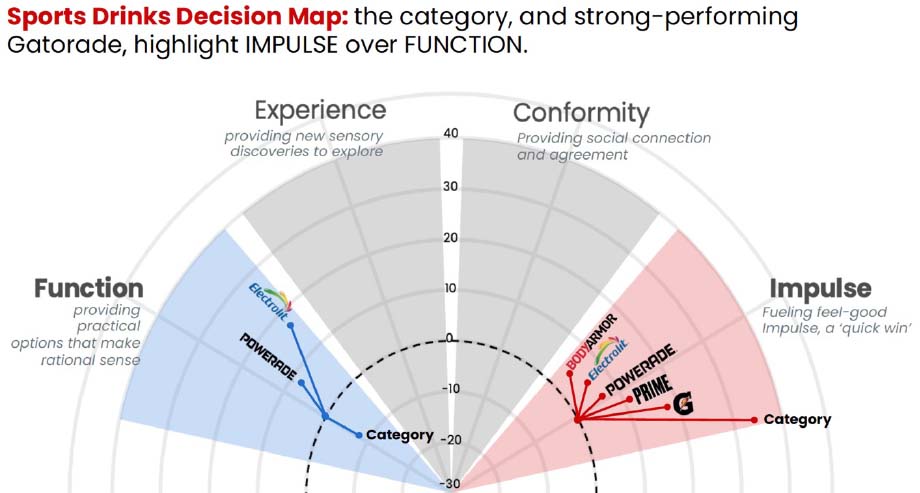

Sports drink category leader (and Bev 50 #1 brand) Gatorade is squarely aligned with the Impulse drive that powers the category. Current brand communications refer to the product as “fuel,” and feature partnerships with top athletes to link the brand to the idea of “winning” and status.

Secondary player Powerade, on the other hand, carries more Functional equity, as does relative newcomer Electrolit. Powerade’s brand messaging is more focused on functional claims like “50% more electrolytes.” PRIME Hydration and BODYARMOR fall somewhere in the middle, delivering on Impulse but not as strongly as Gatorade.

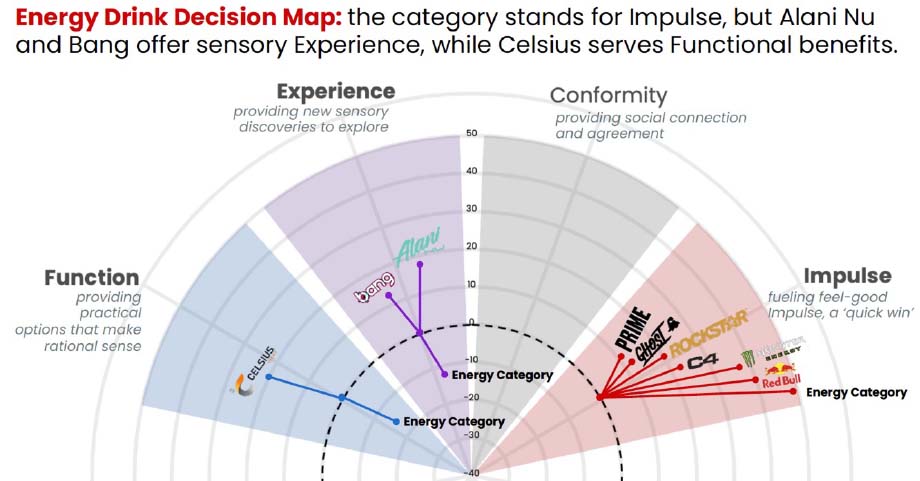

Within the energy drinks space, the Bev 50 data reveal a similar dynamic: established brands Red Bull and Monster are most associated with the feel-good Impulse job that drives the category. Connecting these brands to “winning” is all over their communications strategies, as both heavily feature partnerships with athletes and “extreme” sports to drive the point home.

Meanwhile, some of the newer entrants to this increasingly crowded space show hardly any Impulse signal: instead, they are clearly targeting other emotional “jobs” to differentiate themselves in the market.

A quick scan of Celsius’ website reveals how hard the brand is leaning into the Function job, even claiming the product is “clinically proven to function.” The vibe from Alani Nu and Bang is decidedly more Experience-focused: both brands emphasize sensorial benefits; heavy emphasis on flavors, and evoking desirable settings for enjoying the products over claims about competing, winning, or energy-boosting.

Is serving a different emotional job a smart strategy?

The crowded Impulse “neighborhood” suggests that targeting other emotional jobs is a wise approach for both energy and sports drinks brands. Alpha-Diver’s analysis of the Bev 50 data suggests that more established (in other words, more routinized) brands in a space can gain from offering benefits outside the immediate category’s “job.”

Up-and-comer brands can also bolster their trajectory (drive increasing usage momentum) by offering something different from the competition (à la what Alani Nu, Bang, and Celsius are trying). However, as these brands become more well-known, they should look to drive more toward the category’s Impulse benefit to hold onto their gains and become more routinized with consumers.

So, while the lines between sports and energy drinks might be blurring, decision science explains why, and what to do to stay competitive. There is strong potential for both new and established brands to serve consumers’ emotional needs.

For more insight into how energy and sports drinks brands can do this, the full deep dive report is available for download here.

Photo by Jorge Franganillo on Unsplash