45 Days Into Pandemic Sees Significant Changes In Consumer Activities

Two weeks ago we published the results of the first in an ongoing series surveys designed to track changes in behavior and lifestyle of American consumers due to the coronavirus “lockdown”. You can see the results of the first survey here.

Today’s update, after two more weeks of sheltering-in-place, reveals several subtle shifts in behaviors as well as some not-so-subtle ones.

Shopping, Sleeping, Snacking, and Sex Are Up

Working From Home and Personal Care Are Down

In the past month, the lives of millions of Americans have been upended. Businesses deemed “non-essential” have closed. States have mandated school closures and citizens have been urged not to leave homes except for real the necessities of life – shopping for food or going to the pharmacy or doctor. Sheltering-in or stay-at home orders that started in California have been issued – either state-wide or city/county-specific – in 47 states and now affects more than 300 million people.

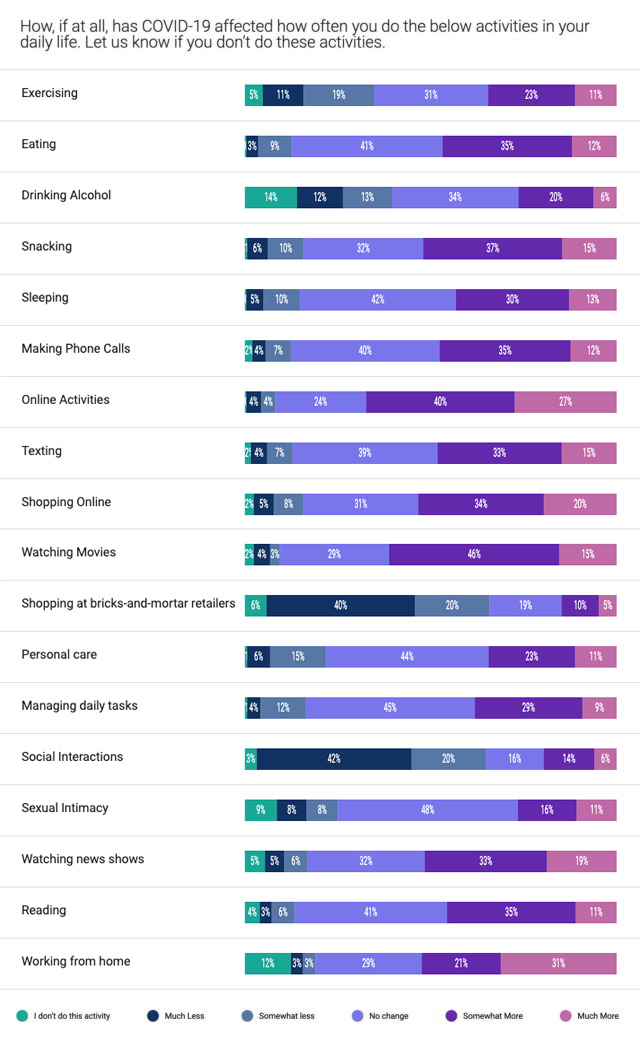

These restrictions have had their effects on 18 daily consumer activities surveyed by Brand Keys, the New York-based brand loyalty and customer engagement research consultancy (www.brandkeys.com) and TheCustomer (www.TheCustomer.net) the weekly newsletter covering the customer insight universe, in conjunction with Suzy (www.suzy.com), the on-demand research software platform.

Sex Is Up, Working From Home Is Down

The initial wave of research found daily and generally routine activities were altered in 78% of 18 activities tracked. Wave 2 of the survey (conducted the week of April 13) found significant changes to 61% of those initial benchmark measures.

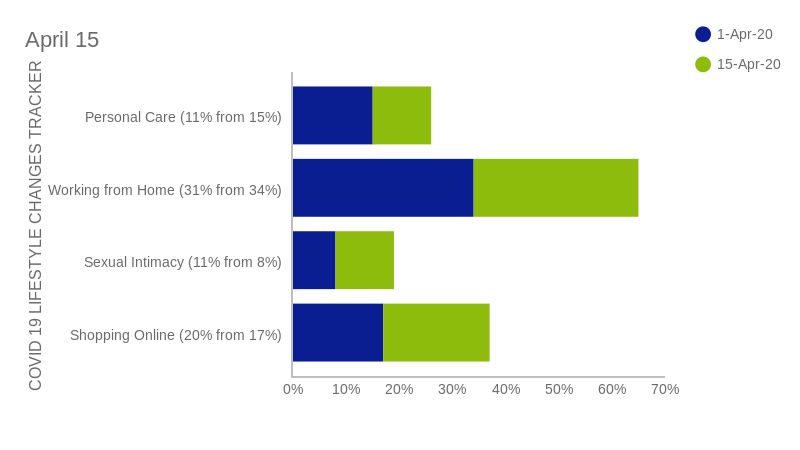

Twenty-two percent (22%) of activities like “shopping online” and “sexual intimacy” are significantly higher. Thirty-nine percent (39%) of activities – like “working from home” and “watching movies”– are seeing lower consumer participation. An equal percentage (39%) saw no change in activities like “Social distancing” and “watching news shows.”

“We suspect that as more people are laid off or furloughed,” noted Mike Giambattista, publisher of TheCustomer, “We’ll see a decrease in people actually having to work from home.” Personal care is down from people participating much more from 15% to 11% in just one week. “If you find yourself getting up later, showering later or not every day, and spending the day wearing sweats or your tee-shirt, you’re not alone.”

The coronavirus pandemic and social disruption has had a real impact on daily life. “Some changes are self-evident, and all are COVID-19 cause-and-effects,” said Robert Passikoff, Brand Keys founder and president. “Even with a flattened curve and a slowing of the infection these are marketplace modifications marketers need to prepare for now.”

What’s Up?

The following 4 activities have seen significant increases in consumer involvement:

- Shopping Online (20% from 17%)

- Sexual Intimacy (11% from 8%)

- Snacking (16% from 13%)

- Sleeping (13% from 11%)

“If you think you see a pattern to these increased consumer activities, you wouldn’t be wrong,” noted Passikoff

What’s Down?

The following 7 activities have seen significant decreases in consumer participation:

- Watching movies (15% from 23%)

- Managing daily tasks (9% from 13%)

- Personal care (11% from 15%)

- Eating (12% from 15%)

- Personal phone calls (12% from 15%)

- Working from home (31% from 34%)

- Reading (11% from 13%)

“Despite what you might think,” said Giambattista, “There’s just so much time consumers want to spend binging, and there’s just so many times you can vacuum your living room.”

What Hasn’t Changed (Yet)

The following 7 activities have seen no changes in consumer involvement:

- Online activities (excluding shopping) (26%)

- Watching news shows (19%)

- Texting (15%)

- Exercising (11%)

- Drinking Alcohol (6%)

- Social (distant) interactions (6%)

- Shopping (brick-and-mortar) (5%)

The New, ‘New Normal’ For Marketers And Customers

“We recognize that the coronavirus has created a ‘new normal’ as regards compulsory, volunteer, and invented consumer behavior,” noted Passikoff, “Ordinarily we’d look at brands first, but these are not ordinary times, and it’s premature to ask about changes in brand preference when the customers’ behaviors are changing so dramatically. Behavior will define the landscape where brands and marketers will have to compete tomorrow and six months from now.”

Methodology

The survey and analysis were conducted the week of April 13, 2020. This week’s Wave 2 findings are based on 1,000 total responses from a U.S. panel population, ages 17-73 with a 50/50 gender split. The survey is being conducted on a weekly basis.

About Brand Keys

Brand Keys specializes in customer loyalty and engagement research, providing brand equity metrics that accurately predict future, in-market consumer behavior that correlates with sales and profitability. www.brandkeys.com

About Suzy

Suzy helps you make better, faster, more data-driven decisions. Their platform combines advanced research tools with the highest quality audience to deliver trusted insights in minutes. www.suzy.com

About TheCustomer

Launched in mid-2019, TheCustomer covers all of the disciplines within the customer engagement ecosystem, exploring the latest research, technologies and personalities driving the customer revolution. www.TheCustomer.net