In the latest edition of TheCustomer QT: Baby steps toward a national data privacy policy, HIPPAA only works as well as the technology that supports it, Brand humanity, the B2B loyalty gold rush, and BOPIS is officially mainstream.

So zippy!

DATA & PRIVACY

It Even Happens in Healthcare

Quick-Take: 2020 was a difficult year for cybersecurity in healthcare, with reported breaches in the sector reaching an all-time high. So far in 2021, the story is much the same, with already 172 data breaches reported by healthcare providers in the US.

Bipartisan Data Privacy Bill Back in Front of Congress

Quick-Take: One of the key terms of the data privacy bill is that platforms write their terms of service in “easily accessible language” that can be readily understood by the average person. End users must also be given the ability to opt out of data collection and tracking; however, platforms would in turn be allowed to deny service to users that opt out. The bill allows providers to disallow both “certain services” or “complete access” in cases where opting out creates “inoperability” in the platform.

CONSUMER INSIGHT

Consumers Want Brands To Be More Human, Finds Study

Quick-Take: Eighty-seven percent of consumers said they’re more receptive to a brand’s messages if they know the company’s beliefs and values. As to why this resonates so well in consumer psychology, respondents said knowing a brand’s beliefs and values makes them feel more trust toward the brand (62%), better know the brand’s authentic identity (44%) and better believe the brand’s purpose (34%). We also saw this thinking play out in regards to marketing messages with political and social issues. Nearly three-quarters of respondents (71%) said they felt positive toward a brand after receiving a social or political marketing message.

Single Customer View as Vital to Customer-Centric Marketing

Quick-Take: Industry research indicates only 35% of customer experience officers believe they understand their customers well, and just 23% of customers say businesses understand them as individuals and cater to their preferences.

Customer insight is driving a new type of marketing

Quick-Take: “Understanding intimately how a customer navigates through the customer journey and those critical touchpoints has made me think about marketing more from a customer experience-led point of view. It’s not only changing the way we find them and the channels, advertising and communication, it’s working with observations and refining and re-engineering the customer experience to match what they actually need as we learn more about them,” she said. “We’re learning all the time and trying to iron out those friction points.”

TECHNOLOGY

Lemonade Backtracks

Quick-Take: In a since deleted tweet from its corporate Twitter account on Monday, Lemonade described using A.I. to “pick up non-verbal cues” in videos that customers are required to provide that help the company detect signs of insurance fraud. As part of Lemonade’s insurance claims process, users send the company videos of themselves “explaining what happened,” the company said in its original tweet. The tweet was part of a larger thread in which Lemonade discussed using data science to lower its loss ratio, referring to how much money it pays out in claims versus how much it brings in.

Marketers Need to Look Beyond MarTech

Quick-Take: According to a 2020 MarTech survey, more than 80% of companies had upgraded a MarTech app in the year prior. Not only will the average large marketing team use 120+ tools, many of these tools and individuals operate in silos. With no interaction they have zero understanding of any other marketing activity, where it fits into the overall strategy, and how it affects customer perception. Marketing strategy simply fails to fit into technical delivery of marketing campaigns. Marketers are under relentless pressure to squeeze out more and more value — to maximise channels, get in front of customers, convert customers, and of course, prove that their efforts are moving the needle. But technology is not, as many marketers believe, the solution to the problem. Yes, great MarTech tools solve problems; they eradicate swathes of tedious manual effort. But technology doesn’t remove the need to understand how the business can differentiate itself, what will capture customers’ attention, what customers need to feel to make them buy a product or service, and how you can create that feeling.

LOYALTY

B2B Customer Loyalty Programs

Quick-Take: In a recent PwC customer survey, almost 60% of B2B customers reported they had never had an experience with a brand that made them feel special. That’s an alarmingly high percentage of customers who’ve been given no particular reason to stick around. But the implications of consumer loyalty for B2B companies are enormous, and, if anything, as crucial as they are for consumer-facing companies.

Could Open Banking End the Consumer Loyalty Trap?

Quick-Take: Fintechs are starting to offer solutions to this ongoing problem through the growth of Open Banking products, usage of which is projected to double to 40m by 2021. Open Banking allows for supplier switching and relevant spending insights to be surfaced from within mobile banking and fintech apps via third party APIs. The majority of consumers rarely engage directly with utility suppliers and track spending from banking or money management apps. Embedding a marketplace comparison tool within a consumer’s existing digital finance app allows for a seamless comparison and switching process, helping to deliver new revenues to banks and fintechs alongside significant added value for consumers. This new age switching technology is not just limited to mobile banking and can be surfaced in a variety of relevant platforms that are seeking to become the single dashboard for a consumer’s financial ecosystem.

Editor’s Note: Let’s not confuse the idea of creating brand loyalists with creating brand hostages. The above-noted apps are clearly designed to stem the latter – and that’s a good thing.

CX

BOPIS Improves the In-Location Customer Experience

Quick-Take: As of August, 75% of the nation’s top 50 store-based retailers were offering curbside pickup of online orders. Adoption of BOPIS and curbside pickup may be even more widespread now. Consumers are responding with their wallets. Target saw a 700% increase in curbside BOPIS sales (also known as Buy Online, Pickup at Curbside, or BOPAC) during Q2 2020. Best Buy attributed 41% of its $5 billion bump in online revenues to BOPIS and BOPAC orders during the same quarter. Customers have adapted to the pandemic by flocking to stores that offer BOPIS. Even before the pandemic became a thing, 68% of American consumers had purchased items using BOPIS or BOPAC.

You can get TheCustomer QT newsletter delivered straight to your inbox each week by subscribing here.

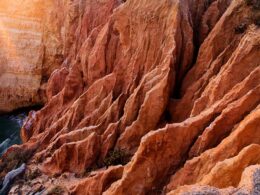

Photo by Tien Vu Ngoc on Unsplash.