For many brands, 2020 will go down as their year of opportunity or failure. Research released last week by Marketing IQ explored the epic level of brand switching this year which has been driven by dramatic changes to product access and household economics. As customers abandon their old brands, this has created an opportunity for smaller and private label brands to stake their claim, while established brands fight to maintain their place in the competitive marketplace. How well brands respond to these opportunities and threats will be key to determining their future.

Since March, U.S. customers have been faced with a radically different shopping experience, one that encourages or forces brand switching. Burdened with an overarching fear of contracting Covid-19, CPG buyers had to navigate stores with limited product availability, restrictions on purchase quantities, a reduced acceptance of cash, in-store distancing, one-way aisles, and mask requirements that created a shopping experience that encouraged customers to minimize deliberation and facilitated brand switching.

The new shopping dynamics have also cast a spotlight on the inadequacies of many brands’ online customer experience and the ineffectiveness of generic retention programs. In many cases, brand-customer relationships proved to be based more on habit than true loyalty or brand affinity. Until marketers create a more relevant experience where, when, and how customers want it, they will struggle to get customers to return to their brands, leaving the door open for lower priced and easier to find brands to build relationships with their former customers.

How Widespread is Brand Switching?

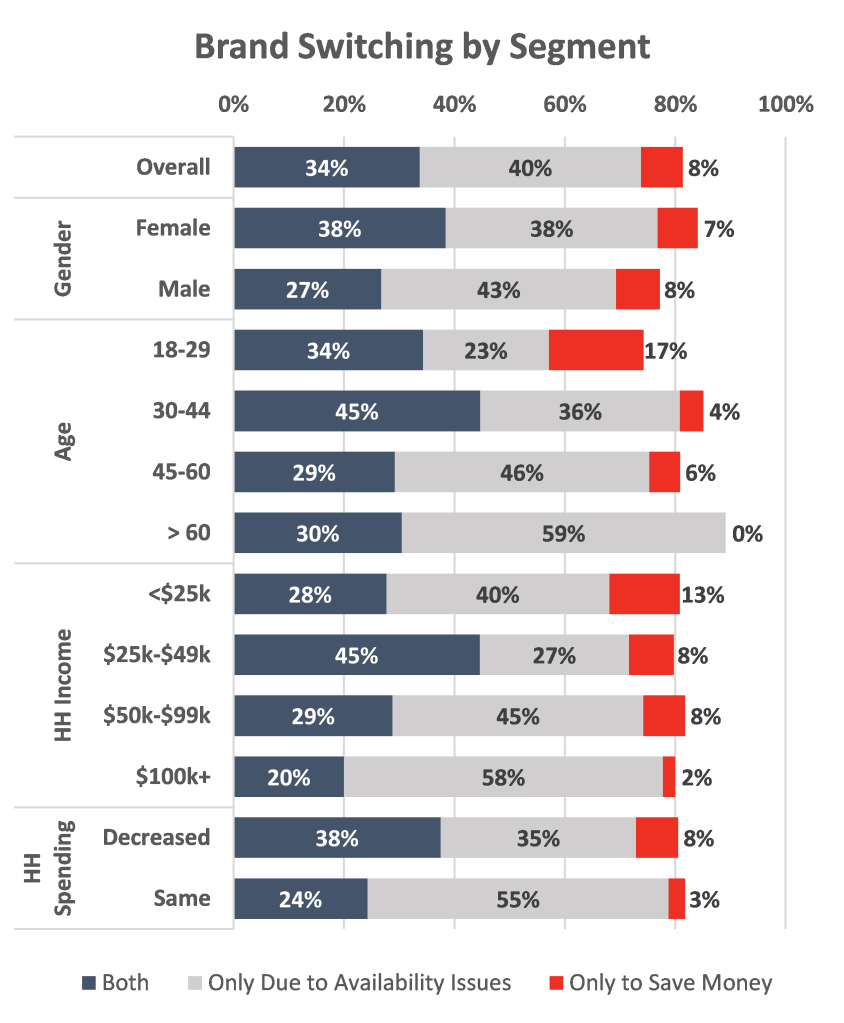

Facilitated by an unprepared supply chain, store closures, and economic turmoil, the scale of brand switching in 2020 has been extraordinary. Our latest research reported 81% of U.S. Adults have switched CPG brands due to Covid-19 and its economic aftershocks. 41% switched brands to save money and 74% switched due to lack of product availability (34% reported switching brands due to both factors). While this overall behavior varied by demographic segment, none were below 74%.

Although product availability was the top short-term reason customers switched brands, the economic hardships caused by the recession may turn out to have a larger and longer lasting impact on purchase behavior. Those that reported switching brands to save money were 66% more likely to have decreased their household spending than those who did not have to change their spending behaviors. Similar skews were also seen with those under the age of 30. Consumers age 60+, high income households, and households that did not have to reduce their spending were the least likely to have switched brands to save money, but their switching behaviors were only low in comparison to those exhibited by other consumer segments.

“Consumers were forced to try different brands when shelves were stripped bare, a problem that transcended all demographic audiences. This has created a unique opportunity for many smaller brands, that might have struggled under the weight of the ad spends of the big brands, to reshape their category landscape and gain a national foothold.”

– John Hamacher | Category Management Industry Veteran

Will Switchers Return?

Brands are in for a rough ride. With so many customer switching brands, some will undoubtedly find brands they like as much as, or more than, the brands they previously purchased and will not return. If these new brands are also less expensive, then there is little incentive for customers to switch back. Although a lack of product availability was the most frequently cited reason a customer switched brands (74%), there is strong reason to believe many will not return to their old brands when availability issues are resolved. 46% of those that switched due to availability issues also cited saving money as a reason they switched brands, a consideration that will persist as long as the recession continues.

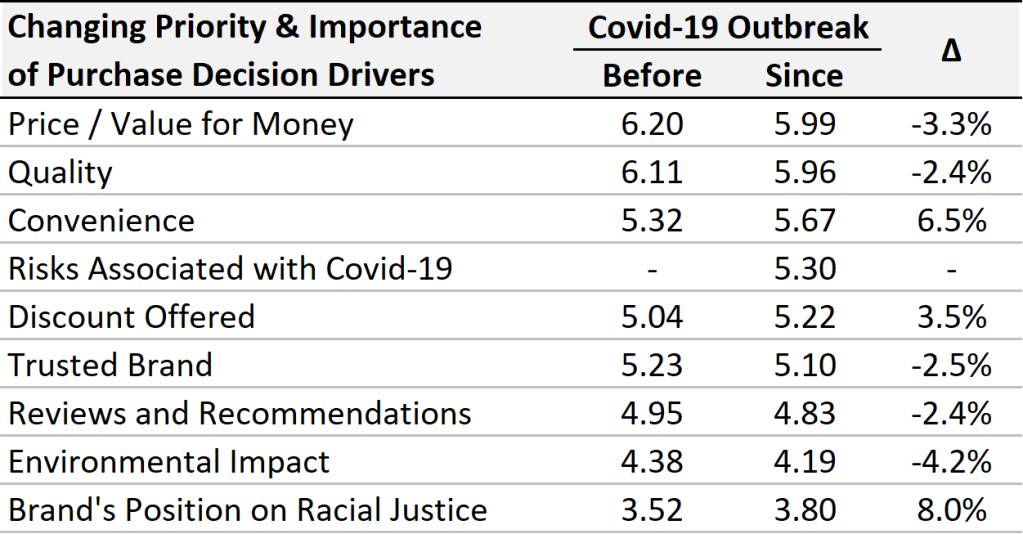

As repeat purchases take place, new product loyalties will develop decreasing the likelihood a customer will return to an old brand. New product trial of previously unfamiliar brands will give customers a better point of reference regarding product Quality, a top decision driver in the CPG purchase decision making process along with Price / Value for the Money, that will better inform their future purchase decisions. As long as the new brand is readily available, or at least as much as their old brands, then the new brands will be in a strong position relative to the customer’s old brands across the top three decision drivers (Price, Quality, and Convenience).

Brands will not be sitting around with fingers crossed, hoping customers come back. With so many first-time buyers, this is an opportunity for brands to cultivate new relationships and strengthen existing ones. These relationship building efforts will need to be more digital than ever as 43% reported they started using grocery delivery or pickup for the first time, and 26% started using a new shopping app (not CPG specific).

“Creating a truly engaging online experience that keeps customers coming back will require brands to do some soul searching and a commitment to understanding who their customers really are, not who marketers think they are. If they didn’t know their customers well before the pandemic, they surely won’t recognize them now.”

– Kathy Hecht | former CMO of Silver Star Brands and American Greetings

The Rise of Private Label and the Decline of Price Premiums

Private label brands, also known as store brands, have experienced significant sales gains over the last decade in most CPG categories, slowly eating away at branded products’ market share.[i] Covid-19 induced panic-buying accelerated this trend with 25% of U.S. consumers reporting they bought a new private label brand for the first time due to the pandemic, and 80% stating they intend to continue buying the private label brand according to a new study from McKinsey & Co. As traditional brand availability faltered, products like Walgreen’s Nice disinfecting wipes, which cost 13% less than those sold by Clorox, sold out in March, and are still in high demand as of August.

“There has been a stark difference between non-commodity brands that have experienced premiumization versus commoditized products. This has been magnified by changing usage scenarios. We have seen wine buyers stick with the brands they know, and pay a little more because it is still 2x to 3x less expensive than what they were paying in restaurants.”

– Lisa Kislak | former CMO Crimson Wine Group

In commoditized product categories, differences in quality perceptions have largely (or entirely) been driven by brand marketing. In fact, many of these lesser known brands are produced by household names like General Mills, Duracell, Huggies, and Starbucks. If pandemic induced product trial leads customers to realize that they can purchase products of the same quality for significantly less, those that are especially burdened by the recession will be far less likely to revert to their old brands. As the recession to date has shown, even consumers with stable household spending are looking for money saving alternatives (27%), indicating ongoing economic concerns may curtail a general return to commoditized brands with increasingly hard to defend price premiums.

Pursuing Opportunities

With brand loyalty in flux, there are new opportunities for all brands to win new customers and build stronger relationships. Economic considerations, health concerns, and product availability will continue to be a part of the consumer mindset and should be part of marketers’ too. Brands should consider the following to improve customer retention and acquisition initiatives:

Listen to Customers: Brands need to listen to what customers are saying and doing. Reevaluate customer behavior data trends and conduct market research to better understand and address their evolving needs.

Evaluate the Online Experience. Review and refine the online purchase process to reduce purchase barriers, and the relationship building elements of your customer communication portfolio. If 80% or more of your messages are promotional, create a better balance with more relationship building touch points. Eliminate unnecessary opportunities for customers to opt-out of communications as this reduces lifetime value.

Fight the Instinct to Raise Prices. Given the dramatic economic changes to many U.S. households, and switching behaviors designed to reduce spending, price increases will hinder efforts to recapture lost customers.

Reconsider the Brand’s Competitive Set. It is not who marketers think of as their competition, but who the customers think of as a competitor or a substitute. Understanding this will be key to creating effective strategies and tactics.

To read the full research report, Consumers on Edge: Understanding The Changing Dynamics of Consumer Purchase Decisions click here.

For more on optimizing your customer communication programs, putting your data assets to work, or conducting market research click here or email us at [email protected].

[i] Nielsen reported that in 2019 private label sales grew 2.5 times faster than branded products over the last 4 years.

This article originally appeared in MktIQ. Photo by Morning Brew on Unsplash.