The Covid-19 pandemic is accelerating consumer behaviour shifts which were underway even before the crisis hit, according to a recent consumer insights report from PwC Canada. Retailers will have to increasingly tailor their customer journey strategies to the buying behaviours of Gen Z consumers, and a larger work-from-home workforce.

PwC surveyed 1,002 consumers in Canada pre-Covid, focusing on the large urban centres of Toronto, Montreal, and Vancouver. A follow-up survey was conducted with 1,000 Canadians in spring 2020.

Canadian consumers have a higher risk perception of the pandemic than US consumers, which could hold them back from regular shopping patterns for a longer period, according to the consulting firm.

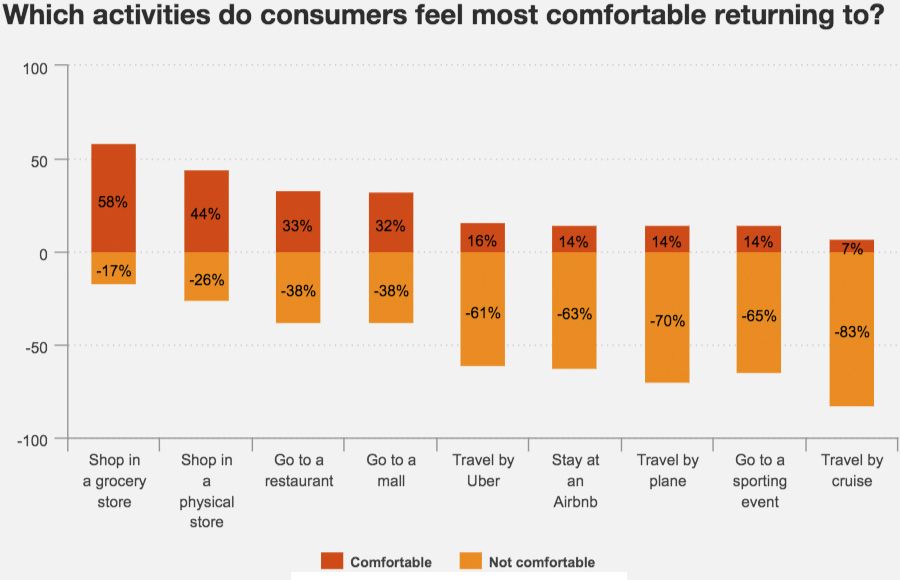

Canadians are least comfortable resuming activities related to tourism (cruises, air travel, and hotel stays) and large gatherings. Bars and movie theatres are also unlikely to bounce back as quickly.

Canadian consumers are most comfortable shopping in a grocery store (58%), followed by shopping in a physical store (44%), going to a restaurant (33%), and going to a mall (32%).

As the Covid-19 pandemic continues to make its impact felt, retailers will have to focus on several key shifts when formulating their long-term strategies.

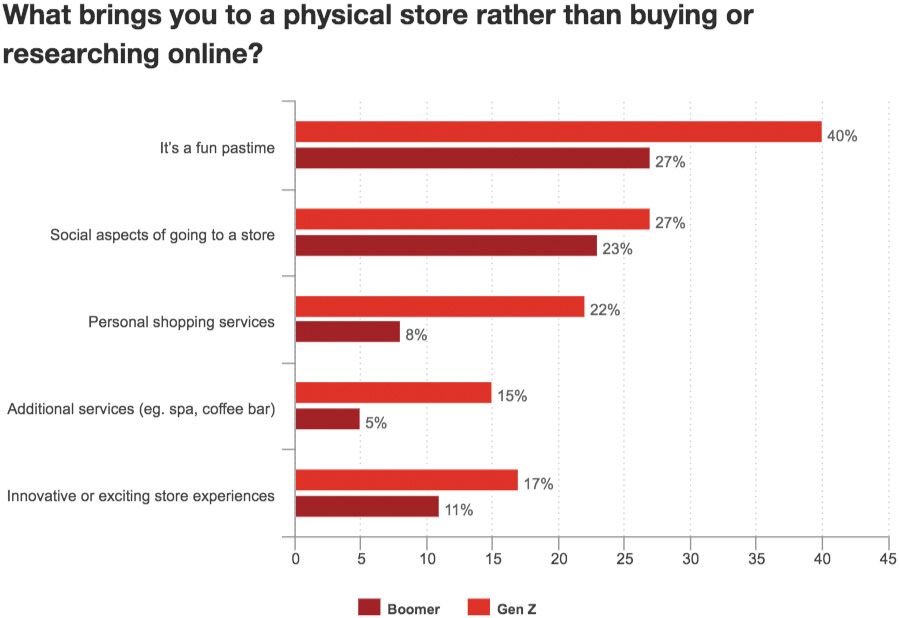

Retailers will firstly have to pay attention to the buying behaviors of Gen Z (aged 18-22) consumers, as their habits will increasingly shape consumer patterns in the coming years.

Gen Z are 25% more likely than boomers to buy their products online at least half of the time. Gen Z are also more likely to use other online food options, such as food delivery apps and meal kit services. Thirty-eight percent of Gen Z buy groceries online compared to 10% of boomers, while 37% of Gen Z buy clothing and footwear online versus 16% of boomers. In terms of apparel, only 20% of Gen Z consumers primarily buy clothing from a department store, compared to 33% of boomers.

Gen Z consumers are also more likely to want additional services in physical stores, such as personal shopping services, a spa or coffee bar – which stems from their greater likelihood of viewing a store visit as a “source of fun.”

Gen Z (42%) are also more receptive than boomers (27%) to automated checkout options.

Second, the shift to remote work will also have implications for retail strategies. Remote workers are likelier to be younger and wealthier, and are approximately 20% more likely to have Amazon Prime and use online as a primary channel for holiday shopping than people who don’t work from home. Remote workers and Gen Z are also more likely to shop for food in microtrips, although such a practice is less socially responsible in a pandemic context.

PwC says retailers will have to put more resources into online product discovery as e-commerce grows, while also adapting their product mix (e.g. offering more athleisure products as people cut down on business clothing purchases).

Third, the pandemic has accelerated shifts retailers have been dealing with for years. Grocery stores have seen a huge surge in demand for e-commerce and delivery services, especially from Gen Z. The younger consumers also favor fresh items and ready-to-eat meals, according to the report.

These Gen Z tastes, however, add costs. In a sputtering economy where food prices are increasing and the coronavirus continues to rage, will people really want to (or be able to) spend the extra money on marked-up meal kits? Delivery services at grocery stores also add significant costs, which the well-to-do can spring for, but not everyone.

Gen Z also have more interest in locally-made, environmentally sustainable, and socially conscious products – which, once again, bolt on significant costs. Add to that the generation’s desire for enhanced experiences and additional services at physical locations, and a unified picture of expensive preferences takes form. Whether these tastes can be sustained or addressed in a recession or depression context is another question.

This article originally appeared in Consulting.ca. Photo by Jelleke Vanooteghem on Unsplash.