When I was in Moscow last on business, I was struck by two older women sharing bananas on a bench with such relish. Later I learned that bananas had been especially scarce during the cold war.

By Elissa Moses, CEO, BrainGroup Global

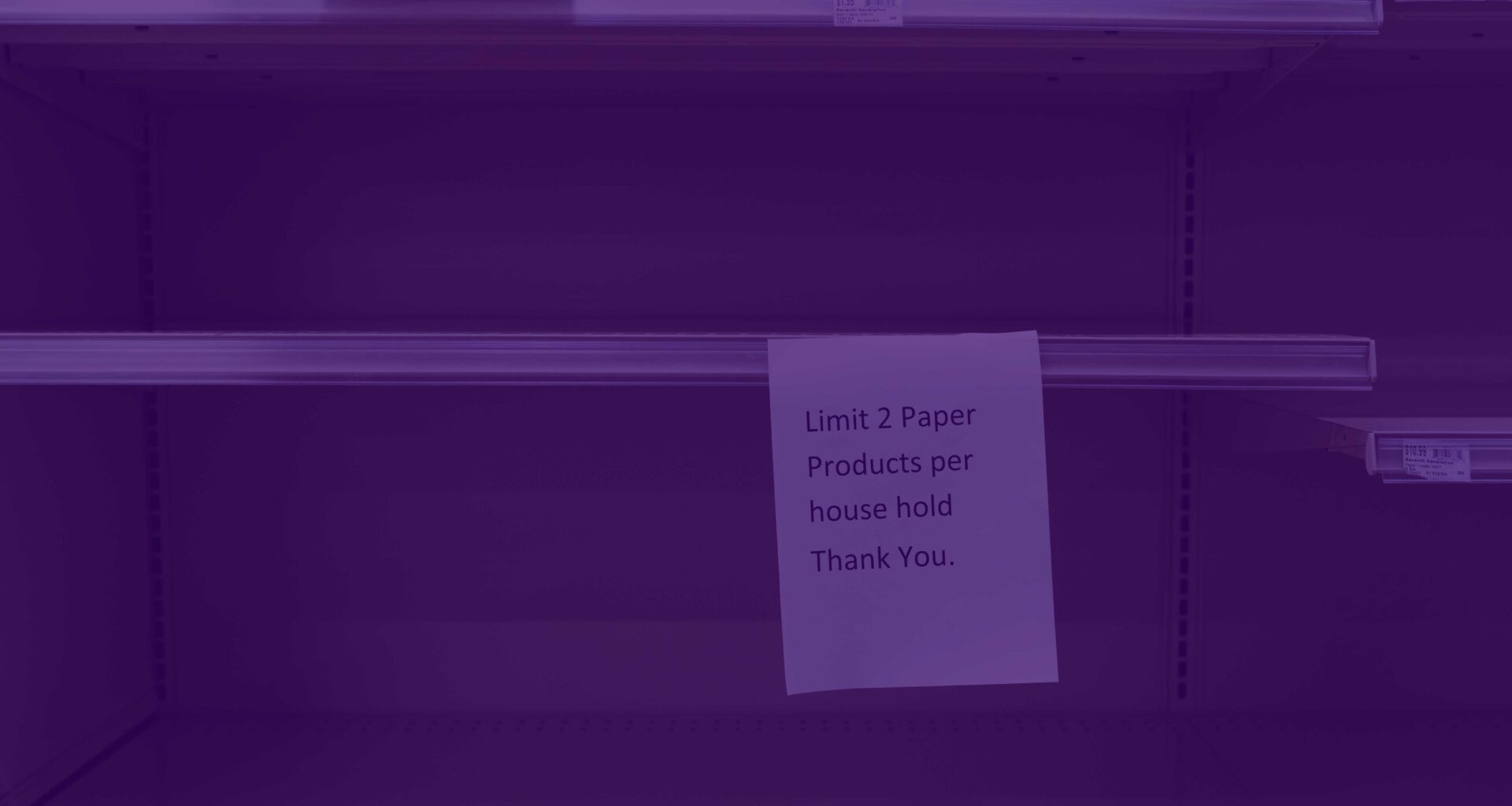

Most Americans have not needed to long much over preferred products or brands for decades. In fact, the whole premise of marketing is based upon abundant brand and product choice. But what happens, when its increasingly difficult (or inconvenient) to get your favorite item, as now with the sudden market situation due to Coronavirus? Should we hold out and exert extra effort to get Cheerios instead of “Morning O’s?” or Dixie plates instead of “Chinet?” These and many others are the choices we face now as stores are sold out of our usual brands or we have shopping services such as Instacart tweeting every couple of minutes questioning our willingness to substitute. Should we hold out and get the brands we prefer or just make do? Rarely has getting what we want been such a challenge in America!

We are not only changing the way we shop, but our sense of entitlement for having what, we want when we want it, amongst the vast array of consumer goods is quickly slipping away. We tell ourselves that we are mature adults in the face of a crisis. Maybe we do not “HAVE TO HAVE” our beloved Quilted Northern Ultra Plush when all the store we are in has is “Complete Home Absorbent” and our face mask is tight, and we want to get home out of this germy environment. Should we bother risking our lives and going to another store or calling yet another delivery service or even waiting (who knows how long now) for Amazon to arrive (if they even have it.) This new paradigm of American scarcity has led to the following marketing predictions.

Prediction #1

Consumers are going to become much more accepting of trying new brands as substitutes and once that door is open, their inflexibility to only accepting their preferred brand is likely to be changed permanently. Some of the new brands they try are frankly going to be as good or better. Some will be cheaper or have better fragrances or packaging. Shoppers will begin to stay on this new path of little resistance when the price of inconvenience weighs heavily in the purchase decision.

The reality is that leading brands must differentiate themselves now more than ever and strategically accentuate their competitive advantages. They cannot rely on habit during these times of scarcity Otherwise preference and the expected stability of market share is apt to erode with an acceleration that has never been seen before. This is especially true for market leaders.

Moreover, Second tier and challenger brands have the most to gain right now. If the circumstance of scarcity forces shoppers to try new brands and those brands deliver, genuine preferences are likely to shift in favor of brands that were never considered before and tried only out of scarcity.

Prediction #2

The tilt toward online shopping with e-commerce and m-commerce (purchasing on mobile phones with even smaller screens) raises the stakes and makes it imperative that products be clearly identified for just brand names, but their quantity, weight, # of items etc. in addition to their trademark. It is predicted that many consumers will be dissatisfied with orders when they do not get the quantity, flavor, or package size that they were expecting.

Case in point, after a long wait for the very expensive Tom Ford Eyebrow Mascara from Amazon, I was certain that my order was wrong when I received one mascara instead of two. For $98.98, (over twice the normal cost) and this picture below, I was convinced that I had purchased two. Note how the picture is dark, there is no conspicuous labeling and two wands are featured.

Feeling “ripped off” even though the error may have been mine, I am more likely to order cosmetics direct from the manufacturer or local retailer next time. Where the advertiser is complicit is in not properly visualizing and communicating the offer. Online retailers need to adhere to the clear communication of the “Four Basics” of online sales product communication: Brand, Format, Variant and Quantity to assure that they can purchase correctly and without disappointment at delivery.

Prediction #3

Advertising will continue to become more serious. With our lives and the world in chaos, with threats all around us, while being cut off from loved ones, leading brands need to rethink their strategies for relevant advertising messaging, media placement and overall marketing activities.

There is a new undercurrent of somberness to our daily lives. Frivolous brand messages feel out of place and consumers want to know, what is a brand or its parent company doing to make my life and other lives better? Are they taking a stand? Being charitable? Lowering prices? Offering some type of relief? This is not to say that fun, clever, amusing advertising (my favorite) has to be put down forever, but that the importance of mirroring the cultural zeitgeist and being relevant to the times is at an all-time high.

A controlled study on ad effectiveness based upon COVID- themed messaging and placement in news versus comedy shows, recently released by Duane Varan, CEO of MediaScience, found that strong COVID relevant messages placed in a news format did the best. For example, an ad highlighting “contactless delivery” for Domino’s Pizza outperformed its traditional ad and especially when seen in a news context. And yet, conversely, a COVID-themed ad for a burger brand did not hit the right message and performed worse, particularly in comedy programming.

Prediction #4

There will be new definitions of luxury and status. To be honest, I have a closet full of designer clothes, shoes, and purses. I rationalized that I “needed them” to present the right image in business as a CEO and frequent speaker. But with Covid-19, I have transitioned to wearing tank tops over yoga pants every day, with an occasional cardigan thrown over for warmth or an attempt at Zoom meeting “fashion.” When am I going to get a chance to enjoy my new spring Lafayette 148 suit and Ferragamo shoes I wonder, bought faithfully for seven conferences on my calendar that got cancelled due to the Pandemic?

Luxury and status can no longer be signaled though apparel, jewelry, or fancy cars if in fact we barely ever see anyone in person outside of our immediate housemates. Moreover, the luxury of experience many of us have so enjoyed in the form of foodie restaurants, adventurous vacations or scarce tickets to sports music or theatrical performances are no longer in reach.

I worry that many brands, establishments, and venues will not continue to exist. Our society will need to create new ways to differentiate ourselves and find goods and experiences to dream about and make life special.

I recently ordered a “farm to table” dinner box with the freshest ingredients, recipes and a “how to” video included. It was a complicated meal to prepare of stewed goat, fancy salad and vegetables and it was it truth one of the most delicious things I have ever prepared. This is a new luxury.

But what are the decades old established luxuries to do from here? How does Louis Vuitton become an at home experience? (If anyone can do it, this highly imaginative, tech savvy company can.) I was on an executive Zoom call about coping with Coronavirus yesterday and multiple women said they are purging their closets of designer shoes. This does not bode well for Christian Louboutin. There will need to be some fresh ingenuity to preserve some of our beloved luxury brands from giving way to irrelevance. No one can admire our feet on a Zoom call.

Prediction #5

Market research methodologies are changing rapidly to accommodate COVID-19 limitations, and many will most likely become the new normal. 2020 was the year the tried and true focus group went on a ventilator. Facilities shut and even unemployed respondents did not want to sit around a conference room talking to strangers for a handsome cash incentive. Pre-Pandemic, in person focus groups and 1-on-1’s (individual interviews) represented 80% of the qualitative research market and now it is zero. Virtually all has shifted to online. Not only have focus group facilities closed, but so have neuro labs that require in-person measurement of eye-tracking, biometrics, and EEG response.

In its place, on-line and in-home research is surging and with it new, innovative techniques, especially those for getting at emotional response and predicting preference.

Part 2 of this article will address insights to enhance brand competition in the age of Covid-19 that have come from emerging market research methodologies. I will spotlight new methods in our sphere that warrant consideration including: EmOcean™, Fast Focus™, StreamPulse™ and HARK Connect™

Stay tuned.

Elissa Moses is CEO of BrainGroup Global and partner in HARK Connect and Bellwether Citizen Response. She is a leader in developing scientific and tech enabled new methods for measuring human emotions, influencing consumer behavior, and strengthening brand strategy. Formerly she was the CEO of the Ipsos Global Neuro and Behavioral Science Center, Chief Analytics Officer at EmSense, Managing Partner at Grey Advertising and SVP, Head of Global Consumer Intelligence and Strategy at Philips. She was also the head of Planning at DMB&B and Founder/Managing Director of BrainWaves. Elissa is a frequent industry author, including a book on marketing to global youth, The $100 Billion Allowance, and a popular international speaker. She is a member of C200, a corporate advisor and seeks board opportunities. [email protected]

Elissa Moses is CEO of BrainGroup Global and partner in HARK Connect and Bellwether Citizen Response. She is a leader in developing scientific and tech enabled new methods for measuring human emotions, influencing consumer behavior, and strengthening brand strategy. Formerly she was the CEO of the Ipsos Global Neuro and Behavioral Science Center, Chief Analytics Officer at EmSense, Managing Partner at Grey Advertising and SVP, Head of Global Consumer Intelligence and Strategy at Philips. She was also the head of Planning at DMB&B and Founder/Managing Director of BrainWaves. Elissa is a frequent industry author, including a book on marketing to global youth, The $100 Billion Allowance, and a popular international speaker. She is a member of C200, a corporate advisor and seeks board opportunities. [email protected]

#CoronaMarketing #BrandLoyaty #CovidMarketingOpportunities #NewMarketResearchMethods #IAT #ImplicitMethods #Emotion #ecommerce #mCommerce #CovidAdvertising #CovidMarketingPredictions #BrainGroupGlobal #MediaScience #BellwetherCitizenResponse #FastFocus #HARKConnect #StreamPulse #EmOcean #MerchantMechanics #Glynwood #Netflix #Onlinefocusgroups #luxurygoods #brandscarcity

I loved your article and your predictions and I think that your insight is superior and well focused. As far as status identifiers within our new emerging interactions at a distance, I am finding that those that are discovering new brands, items or experiences and are willing to share them are seemingly gaining in personal popularity when in the past they were ignored. Additionally, I believe that now that more people have more time and ‘if’ theaters and other entertainments reopen to the public, the costs are going to be lower because they will need to be to attract those that are less reluctant to venture out. The Value/ Worth relationship will go through a kind of correction and perhaps revert to something like it was in the 70’s. I may be wrong but just something to consider.

John – thanks for your thoughtful comments. All credit for this point of view goes Elissa Moses, the author of this piece. But for our part, we completely agree – we should expect a correction / re-balancing of the value & worth factors not only for entertainment and luxury segments, but across most major categories.

John Pyrch thanks for your favorable response and thought provoking comments! One of your observations really hit me. As much as going to a movie theater is my abolutely favorite night out, I am not sure I will ever experience that again. It would mean that the Pandemic would have to be officially over. Here’s hoping.