On a personal note: When I first saw the numbers coming on the heels of restaurant closures, I couldn’t help but think about the horrible movie Demolition Man in which every restaurant in the future was a Taco Bell. How they got there has nothing to do with the challenges the industry faces today, but with the permanent closure of many of our most cherished places to eat, where we connect with other human beings, and where we explore other cultures through food, the restaurant industry is most definitely at a critical crossroad.

There are few industries that have been devastated by Covid-19 as much as the restaurant industry and it very well may be a harbinger for sweeping changes across many other industries. As it stands, 97% of U.S. restaurants are now closed for on-site dining. While many other hard-hit industries like energy, automotive, and airlines will benefit from being considered critical infrastructure sectors, restaurants enjoy no such protections and will be forced to adapt or perish. With on-premise capacities expected to be cut in half, and private events curtailed for the foreseeable future, past business models and cost percentages will not be sustainable for most in the industry. The industry is fighting back as innovators in the space are finding creative ways to reduce the impact and build their brands in anticipation of an unshackling of pent up consumer demand.

By Marc Shull

The impact on the restaurant industry has not just affected guests, but employees and suppliers alike. According to Commerce Signals restaurant revenues were down an estimated 60% year-over-year for the week ending April 4th. 91% of hourly workers and 70%[i] of salaried workers have been laid off out of the industry’s estimated 15.6 million employees making the projected overall July U.S. unemployment rate of 15%[ii] seem like a relatively minor blip. With business models ill-designed to handle this type of change, those that survive will not be able to continue business as usual. The lessons learned so far across the industry’s product and service offering, employment strategy, and supply channels can be applied to other industries.

Putting Things into Perspective

Lost in a sea of unprecedented changes to the economy, the numbers coming from the restaurant industry still look staggering in comparison and are linked to broad changes in social and consumer behaviors that go far beyond this industry. However, when we get past the initial shock, we see the numbers provide insight into the future of dining and how innovative brands will survive. Our key insights from industry data are:

Diversification Has Mitigated Loss: QSRs which usually support off-premise dining saw a year-over-year transaction decline of 40% in the last week of March 2020 compared to a decline of 79% for full-service restaurants which often lack developed carry-out and delivery options.

Channel Dynamics Will Never Be the Same: Before the outbreak of Covid-19 and the ensuing closures, on-premise accounted for 52% of industry revenue, carry-out 25%, drive-thru 18%, and delivery 4%. Digital orders represented 13% of all off-premise dollars for the trailing 12 months ending February 2020. [iii] With 97% of restaurants only available for off-premise dining or completely shuttered, channel revenue dynamics have dramatically shifted. When on-premise dining reopens, social distancing is expected to reduce the number of possible covers in half and effectively eliminate private events, which will severely hinder the industry’s ability to rebound.

The Old “Unwritten Rules” No Longer Exist: Everything is on the table. When 3 Michelin Star restaurants like Alinea started offering carry-out in tin containers it had to make you look up to see if pigs were flying by. While tin container carry-out is a major departure for experience-positioned restaurants, higher end brands may find off-premise to be a viable offering post-pandemic if they can more effectively convey the brand experience to justify the price premiums. Delivery only restaurants, also known as Ghost Kitchens, have been around for years but the current situation has business booming. [iv] Demand has doubled for companies in this niche like C3 that were already planning to hire in support of their expansion plans.[v]

Consumers Are Burned Out on Covid-19 Messages: The harsh truth is customers who last engaged with a brand 5+ years ago don’t care what the brand is doing to keep their Topeka employees safe. Their employees sure do, but after being bombarded with hundreds of nearly identical emails the single mom in Baltimore that just got laid off is too busy trying to figure out how to home school her children to care about any message that doesn’t immediately improve her situation. This is playing out in engagement metrics from March 2020 email campaigns. Despite a 56% year-over-year decline in the number of email campaigns and a slightly higher average open rate, the average deletion rate jumped 52% with Covid-19 related emails even higher at 64%.[vi] The message is clear, recipients are burned out.

Substitutes are Gaining Viability: In just the last half of February, downloads of the grocery delivery app Instacart increased 215% even before mass restaurant closings took place. Rakuten reported ecommerce grocery orders had spiked 250% by mid-March.[vii] The number of households ordering groceries online has doubled since before the outbreak and 43% say they are likely to continue buying groceries online after the pandemic ends.[viii] An early April 2020 study showed a net of 43% of U.S. consumers were cooking more at home while those who ordered take out or delivery had declined by 8%, and those purchasing meal prep kits declined 6%.[ix] It is estimated that delivery is 5 times the cost of homemade meals so for many returning to their previous restaurant visit frequency seems unlikely.[x] Even when restaurants are allowed to open back up, high unemployment and fear factors will support higher ongoing levels of at-home cooking, hindering the industry’s recovery.

Mass Job Loss Highlights Industry Financial Fragility: In addition to the majority of industry’s 15.6 million employees being out of work, only 31% of restaurant employers provide healthcare coverage.[xi] In an industry with a notoriously high turnover rate and a world where unemployment checks may appear more stable and a healthier option, providing more stable work environments will be critical for brands to regain and maintain quality staffs.

Innovation is Having an Impact

Despite these challenges, the industry has embraced change like no other. Beyond just surviving, there are those who are planning to come back stronger than ever. Not by taking advantage of people in need, but by recognizing that consumer needs have dramatically changed in a very short period, and by being creative about addressing those changes. Here are some of the more innovative things we are seeing brands do:

Shifting Business Models: Whether it is Tim Horton’s providing restroom access to truckers delivering essential items across Canada or Panera transforming into grocery stores, brands creating temporary business models that fit current consumer needs are building brand equity that will pay dividends when they reopen and are viewed more as contributors to the community and less as evil corporations. Longer term, the effective transformation into ghost kitchens, an approach that was already being adopted by chains like Famous Dave’s prior to the pandemic, is likely to see broader adoption as a risk mitigation strategy and one that lowers cost percentages.

Showcasing Chef Expertise: If there is one thing chefs know, it is how to cook. Established and up-and-coming chefs are bringing cooking to the masses and building their personal and restaurants’ brands along the way. By demonstrating their expertise through online cooking classes, chefs are helping to bring the things their customers love into their homes demonstrating loyalty is a two-way street.

Share the Love: Every restaurant has popular menu items, some are even iconic. Whether it is a recipe or preparation, helping customers enjoy what they love about your brand while stuck at home reminds them why they love your brand and gives them a little taste of comfort. We’ve seen this in the form of Café Ba-Ba-Reeba’s sangria recipe and Sullivan’s Steakhouse’s guide to cooking a steak at home. Now if only McDonald’s would finally get with the program and bring their Szechwan sauce back…

Adaptive Food Trucking: Perhaps already among the most creative and cost-effective approaches to off-premise dining, food trucks are repositioning according to population shifts (away from business centers), adding advanced web ordering that allows trucks to locate near high concentrations of buyers, and adding bull horn order announcements allowing customers to wait at safe distances or in their cars.

Getting Back to Business

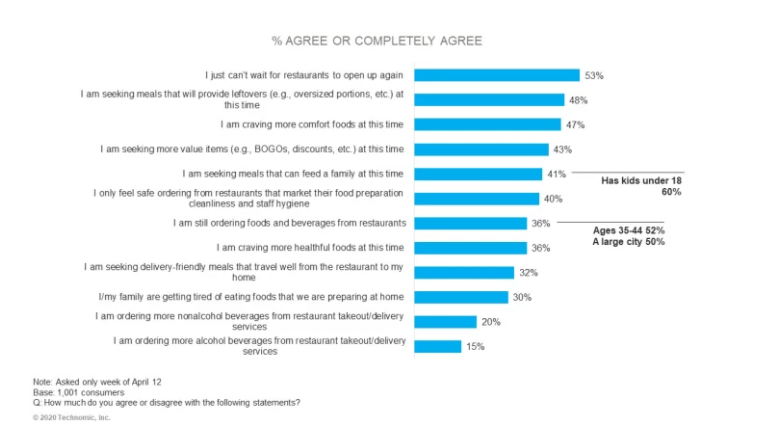

It is NOT all doom and gloom. True, the short-term impacts are unprecedented, but so is the pent-up demand to dine out from those who have been locked away for months on end, and the large number of people looking for work, many with industry experience. 53% of respondents from a recent Technomic survey reported they “can’t wait for restaurants to open up again” and 30% said they were “tired of eating meals prepared at home”.[xii] How well restaurants build and manage demand on the consumer and employee side will be key factors in determining success or failure.

Revise Your Cost Structure Now: With most on-premise seating capacities expected to be cut in half for the foreseeable future, and special events practically non-existent, there is no way the old labor/food/liquor cost percentages can go unchanged. Look at ways to lower your food cost percentage across the menu (ex. reduce portion size, remove items with high food cost percentages, etc.). Reduce the hours the dining room is open to those hours that have enough traffic to justify the labor costs. Focus on-premise promotions on liquor and draft beer instead of wine or bottled beer as they usually have lower cost percentages.

Create a Balanced Plan to Reengage Your Customer Base: Think about customer engagement across three phases: 1) Short-Term (until on-premise reopens), 2) Mid-Term (until a vaccine is found), and 3) Long-Term (post vaccine). Integrate new offer strategies that support today’s realities and builds demand for the day when you can reopen your doors. Do not send the usual barrage of coupons and offers to your entire customer file. Daily emails and SMS messages don’t build loyalty but they do produce high unsubscribe rates which will damage your ability to rebound. Focus on your loyal customers first. Demonstrate how you are making it easier for them in their time of need and implement an offer strategy that drives behaviors that will help your sales today and tomorrow. Piggyback an offer for today that will drive traffic to store at a later date (when on-premise reopens) with something like “show your lock-down delivery receipt for 20% your first dining room visit”. This is also a good time to revisit and revise your CRM programs, especially trigger email and SMS programs that may still be sending tone deaf communications. Customer journeys and experiences will inevitably change and should be embraced if evolving customer needs are to be met.

Leverage Your Loyalty Program: As we wrote about back in 2011, the 2010 National Restaurant Association reported 77% of its members stated loyalty programs helped drive business to their restaurants during the great recession. Additionally, 90% of the respondents said loyalty programs created a competitive advantage for their brand. Even if you do not have a loyalty program in place, you can still create short-term value propositions of a similar nature by leveraging your existing customer data or by employing gamification tools like Voco by 3radical that reward trackable strategic behaviors.

Build Around Customer Needs: While the increase in online ordering is expected to subside when restaurants reopen, online ordering and takeout as a percentage of overall revenue is likely to remain higher than it was before the pandemic. Look at technologies like Chowly to facilitate and integrate 3rd party ordering platforms and internal POS system along with real-time menu changes to build off-premise dining capabilities that will enable your business to better withstand future crises. But don’t limit yourself to digital. According to Technomic, 59% of those placing takeout orders still use the phone to do so. [xiii] Their research also showed what features consumers want when using a restaurant’s app or website for delivery: alerts for order progress and when it is about to be delivered, delivery time scheduling, mobile payment options, and payment information storage to expedite ordering.

Evaluate Your Business Model: Consider diversification to permanently include on and off premise capabilities to reduce the revenue and staffing impact of future pandemics. Evaluate in-house delivery to improve revenue capture compared to 3rd party delivery services and develop a strategy to migrate new customers from services like GrubHub to ordering directly from your website. Even if ghost kitchens are not an option for you on-going, developing a written contingency plan for future times of need will help you adapt quickly and efficiently.

Building the Off-Premise Brand Experience: A service that is built around an in-person experience is hard to recreate outside of a controlled environment like a restaurant dining room. Brands will need to build a more consistent brand experience off-premise to justify price premiums and create premise agnostic brand continuity. Will we start to see high end restaurants include cloth napkins, branded steak knives, and candles to make that in-home date night just a little closer to a romantic night out? Will family friendly chains include place mats and a small box of crayons with deliveries to keep the kids happy? Similarly, brands will need to determine how they will address their increased use of disposables long term. Some brands have already started offering opt-outs for plasticware, napkins, and other accompaniments to reduce waste, ecological impact, and costs.

Keeping Menus Fresh: Keeping favorites on the menu is important, but much like having specials, keeping the menu interesting is key to driving repeat business and can be used to encourage engagement. Get creative by asking customers to vote on what specials they would like to see next, permanently added to the menu, or as a way to create exclusive offers with limited availability items. Menu updates also offer brands the chance to create more budget conscious items that will make the brands more approachable in a market where unemployment is rising fast. Finally, add advice for wine and beer pairings to save them a trip to the store and increase your average ticket.

Reevaluate Your Product Focus: What was your top seller may no longer be when it comes to off-premise. Think about how it might “survive” delivery and what else might provide a better customer experience (i.e. no chocolate soufflés). Also look at your food-alcohol mix and how this can drive greater demand and sales. Demand for alcohol is up and many states, including Illinois and New York, are loosening delivery regulations which provides restaurants with an opportunity to increase the average check amount.

Skip the Delivery Apps: As a customer, order directly from restaurants not through 3rd party apps. While GrubHub may be removing consumer facing delivery fees, they are quietly only deferring charge backs to restaurants which could be a second crushing tidal wave, dooming those that survived so far. Ordering directly from the restaurant will help support their delivery employees and reduce middleman costs.

A restaurant revolution is well underway and other industries should take note of the industry’s innovations, and how they can be applied elsewhere. Those that survive will not be able to continue with business as usual. Fear and opportunity will drive fundamental changes in the industry and accelerate innovation with the hope of building brands that are far more able to withstand future shocks. Whether in the form of a second wave of the Covid-19 pandemic, or some other yet unforeseen challenge, how businesses adapt will determine their future. I just hope we don’t end up with every restaurant being a Taco Bell.

Marc Shull, CEO of Marketing IQ, is a big-data expert with specific competencies in data insights and consumer privacy legislation.

Marc Shull, CEO of Marketing IQ, is a big-data expert with specific competencies in data insights and consumer privacy legislation.

For more on re-engaging your customer base email us at [email protected].

[ii] https://tradingeconomics.com/united-states/unemployment-rate

[iii] https://www.npd.com/wps/portal/npd/us/news/press-releases/2020/with-97-percent-of-us-restaurants-impacted-by-mandated-dine-in-closures-restaurant-customer-transactions-declined-by-42-percent-in-week-ending-march-29/

[iv] https://www.fastcompany.com/3064075/hold-the-storefront-how-delivery-only-ghost-restaurants-are-changing-take-out

[v] https://www.cnbc.com/2020/04/15/coronavirus-restaurants-have-laid-off-thousands-but-ghost-kitchens-are-hiring.html

[vi] https://www.mediapost.com/publications/article/349487/covid-19-disruption-brands-send-fewer-email-campa.html

[vii] https://commonthreadco.com/blogs/coachs-corner/coronavirus-ecommerce#coronavirus-ecommerce-data

[viii] https://www.grocerydive.com/news/nearly-one-third-of-us-households-shopped-for-groceries-online-in-the-pas/575038/

[ix] https://www.slideshare.net/HUNTERNY/hunter-food-study-special-report-america-gets-cooking-231713331

[x] https://www.forbes.com/sites/priceonomics/2018/07/10/heres-how-much-money-do-you-save-by-cooking-at-home/#5929611235e5

[xi] https://d2w1ef2ao9g8r9.cloudfront.net/resource-downloads/2019-Restaurant-Success-Report.pdf

[xii] https://www.technomic.com/technomics-take/coronavirus-foodservice-view

[xiii] https://www.restaurant.org/Downloads/PDFs/Research/research_offpremises_201910

[i] https://www.technomic.com/technomics-take/coronavirus-foodservice-view

This article originally appeared in Marketing-IQ. Photo by Jason Leung on Unsplash.